“Convin has transformed the way we manage quality, collaboration, and communication.”

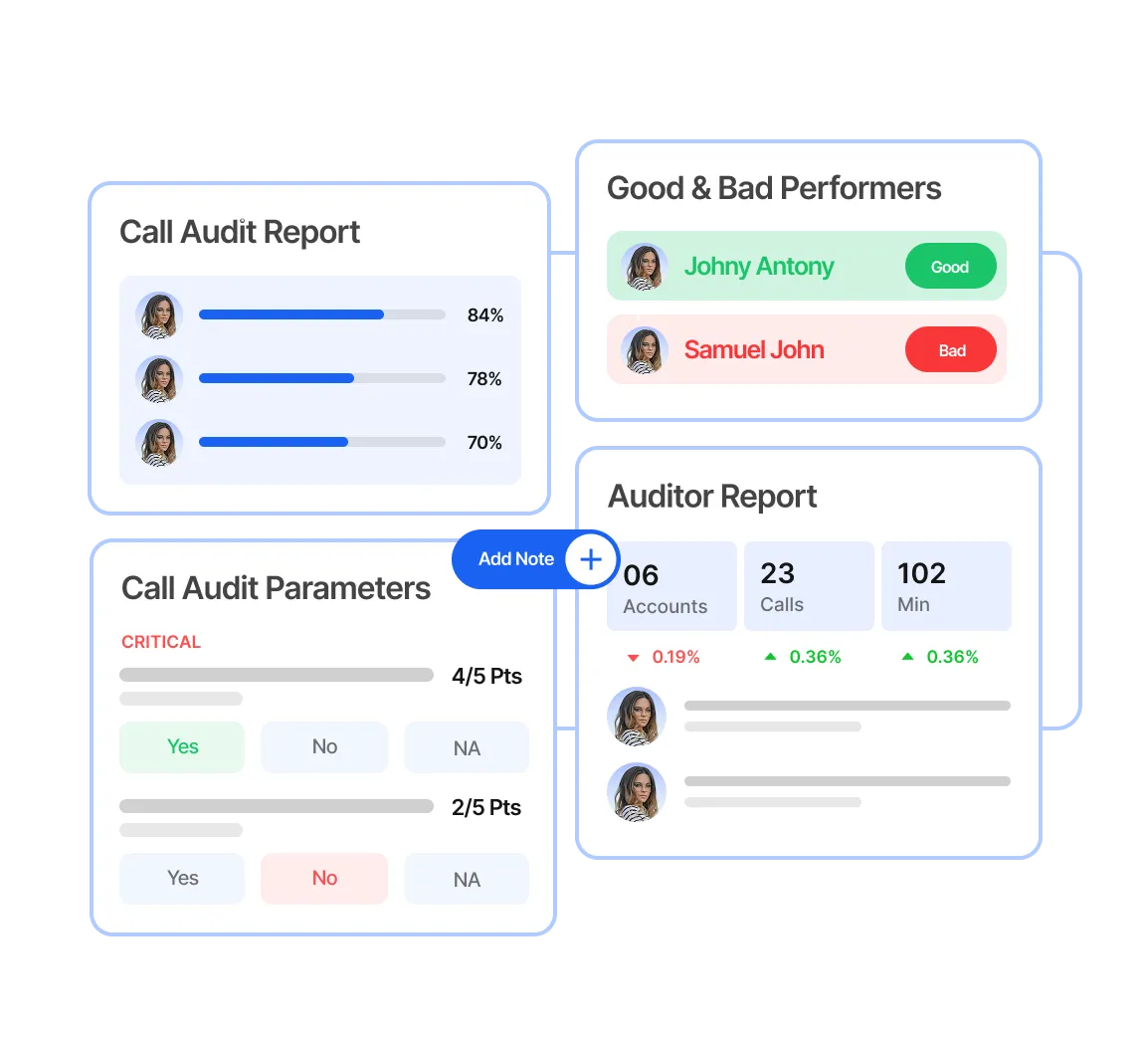

Before Convin, our QA process was scattered across Google Forms and our CRM, making audits, updates, and insights extremely time-consuming. With Convin, everything is now centralized—audits, PKTs, and process updates are easily accessible on one platform. We can make instant changes to audit forms without tech support, and all call recordings are readily available for review and insights. The ability to fill both Audit and Governance Forms simultaneously has boosted QA efficiency, while Team Leads can now track compliance independently.

.avif)