Convin for FinTech

Turn Applications into Approvals. Turn Promises into Payments.

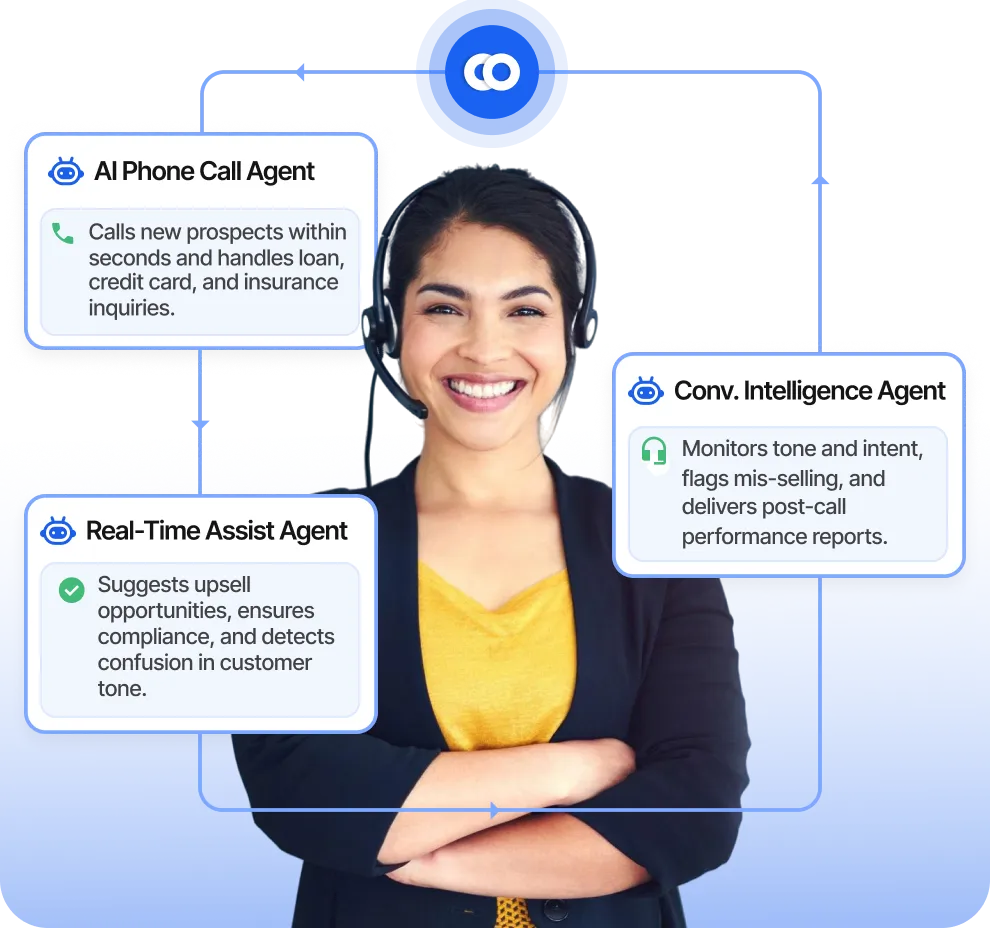

AI Phone Call reaches in minutes, Real Time Agent guides the talk, and Post-Call Analytics closes gaps - so fewer drop-offs and more revenue this quarter.

Convert Conversations into Results

100

%

Audit Coverage

25

%

More upsell opportunites

50

%

Reduction in Errors & Inaccuracies

35

%

Improvement in renewal collection

40

%

Complaints

reduced

reduced

10

X

Jump in Conversions

Revenue Leaks, in Numbers

60%

of claim-related calls still rely on manual checks.

Impact

Slower TATs, poor claim experience, and escalations.

Fragmented systems

(Voice / WhatsApp / CRM)

Impact

Broken customer journeys, missed context, and declining trust.

Fix It in Three Moves

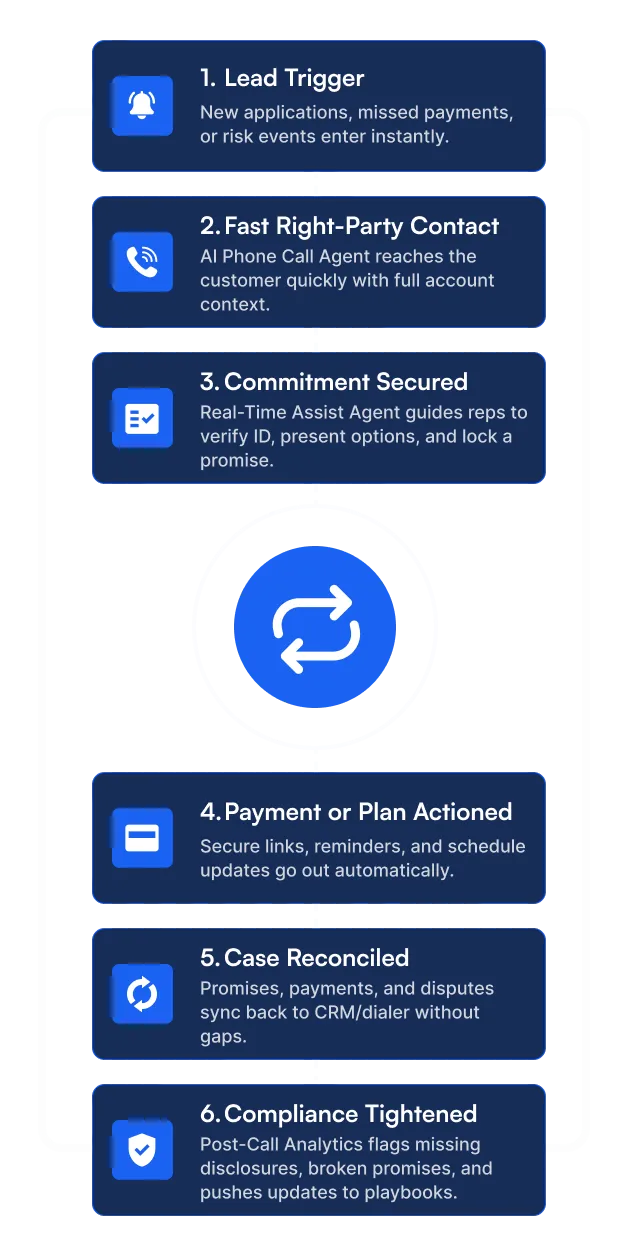

AI Phone Call Agent

Fires on triggers with full CRM/dialer/data-warehouse context-qualifies, books next steps, or routes instantly.

Solves

Missed callbacks

Late reminders

Manual nudges

Use Cases

Payment reminders & retries

Promise-to-pay follow-ups

Hardship/reschedule check-ins

Consent/disclosure capture

Why It Matters

Faster right-party contact

Timely follow-ups

Steadier recovery

Real-Time Assist Agent

Guides tough calls live with precise phrasing and next-step prompts-ID, eligibility, pricing, offers, and secure handoffs.

Solves

Off-script handling

Missed offers

Stalled decisions

Use Cases

Verify identity

Explain pricing/limits

Present hardship/settlement options

Trigger secure payment flows

Why It Matters

Higher first-call conversion

Shorter AHT

Fewer repeats

Conversation Intelligence Agent

Audits 100% of interactions - scores disclosures, promises, tone, and next steps; flags risk; pushes clips for targeted coaching.

Solves

Low QA coverage

Unclear performance drivers

Hidden risk

Use Cases

Detect missing disclosures

Analyze dispute trends

Flag broken promises

Capture intent/upsell signals

Why It Matters

Data-backed coaching

Rising recovery

Fewer complaints

A Closed Loop That Never Loses a Customer

Real-World Convin Use Cases Across FinTech Functions

Acquisition & Growth

Automate speed-to-lead follow-ups within seconds of form submission.

Re-engage incomplete applications with verified identity and context.

Surface intent signals from real calls to drive compliant cross-sells.

Onboarding & KYC

Automate KYC retries and missing document reminders.

Guide customers through welcome calls and first-payment setup.

Detect and resolve address or ID discrepancies automatically.

Collections & Recovery

Automate promise-to-pay confirmations and payment reminders.

Trigger secure payment links for failed or missed transactions.

Manage hardship and settlement workflows with audit-ready proof.

Customer Support & Servicing

Handle balance, due-date, and limit inquiries 24×7 across channels.

Capture and triage disputes with SLA-based routing.

Assist customers in blocking cards or updating account details securely.

Risk & Compliance

Enforce disclosures and consent language in real time during calls.

Capture and reconcile consent and DNC preferences across systems.

Mask sensitive details (PAN/CVV) and maintain PCI compliance.

RevOps, QA & Coaching

Review 100% of conversations with AI-powered auto-QA.

Identify top performers and convert their approach into playbooks.

Assign targeted coaching with call clips and track improvement over time.

.avif)