In the fast-paced world of insurance, call centers play a pivotal role in managing customer interactions and enhancing service delivery. The adoption of specialized call center software tailored for insurance agencies has revolutionized how these companies handle customer queries, claims, and support.

This post explores the critical role of such technology in insurance companies, highlights top software solutions, including Convin, provides a guide on deploying these systems effectively, and outlines their substantial benefits.

Boost Your Insurance Call Center Performance with

Convin's Real-Time Monitoring Technology!

Unlocking the Power of Call Centers in the Insurance Sector

Call centers serve as the backbone of customer service operations within insurance companies, ensuring that client needs are promptly and effectively addressed. These centers are pivotal in shaping the overall customer experience and maintaining competitive edge in the insurance industry. Here's a more detailed look into the key functions and impact of call centers, particularly focusing on the specialized context of insurance services.

1. Customer Support and Query Resolution

Insurance call centers are vital in handling customer inquiries efficiently. Here's how they enhance the client experience.

- First Contact Resolution: Strive to resolve customer queries during the initial interaction to avoid follow-up calls, thus increasing customer satisfaction.

- 24/7 Availability: Offering round-the-clock support to accommodate customers across different time zones and in emergencies.

- Multi-Channel Support: Integrating traditional voice calls with digital platforms such as email, chat, and social media to provide a seamless customer experience.

2. Claims Processing

The efficiency of claims processing is critical for customer retention and trust in insurance providers. Here's what makes call centers effective in managing claims.

- Streamlined Information Gathering: Using call center software for insurance to expedite data collection and claim form routing, ensuring quick and accurate claims registration.

- Claim Status Updates: Providing real-time updates to customers about the status of their claims via outbound calls or SMS alerts.

- Fraud Detection Support: Utilizing advanced analytics to detect possible fraudulent activities, thus protecting both the company and its customers.

3. Policy Management

Effective policy management is another crucial function of insurance call centers, helping to maintain customer relationships and compliance.

- Policy Adjustments and Renewals: Assisting customers with policy changes or renewals, ensuring they feel supported throughout the lifecycle of their policy.

- Educational Guidance: Educating customers on different insurance products and helping them understand the terms and coverage details to make informed decisions.

- Compliance Adherence: Ensuring all customer interactions and policy adjustments comply with industry regulations and standards.

4. Emergency Assistance Services

In times of emergency, the prompt response of call centers can be lifesaving.

- Immediate Response: Deploying quick mobilization features in call center software to escalate emergency calls and coordinate rapid assistance.

- Coordination with Response Teams: Integrating with on-ground emergency services and internal response teams to provide coordinated and efficient support.

- Empathy and Support: Training agents to handle emergency calls with empathy and professionalism, reassuring distressed callers.

5. Integration with Advanced Call Center Technologies

Insurance companies increasingly rely on sophisticated call center technologies to effectively manage these functions.

- Call Center Software for Insurance: Specialized software solutions enhance call routing, information retrieval, and CRM integrations to streamline operations.

- Life Insurance Call Center Features: Tailored features such as beneficiary management and premium reminders to enhance the service experience for life insurance customers.

- Insurance Call Center Vendor Partnerships: Collaborating with tech vendors to keep software solutions up-to-date with the latest features and compliance requirements.

By focusing on these areas, insurance call centers enhance operational efficiencies and significantly improve the customer experience, leading to higher customer retention and loyalty. Integrating advanced call center technologies is key in achieving these goals, underscoring the importance of continual investment in innovation and customer service excellence in the insurance sector.

Top 10 Insurance Call Center Software for Customer Experience

Choosing the right call center software is pivotal in improving both the efficiency and effectiveness of customer interactions within the insurance sector.

Below, we explore ten top software solutions that can transform the customer experience in insurance call centers, detailing their functionalities, impacts, and key features.

1. InsureConnect

- Functionality: InsureConnect offers a comprehensive suite tailored specifically for insurance companies. It features integrated CRM and automated call routing to streamline operations.

- Impact: By facilitating faster and more effective customer interaction management, InsureConnect significantly enhances service speed and quality.

- Key Features:

- AI-Driven Insights: Utilizes artificial intelligence to provide actionable insights into customer behavior.

- Real-Time Data Analysis: Offers live analytics to help adjust customer service strategies dynamically.

- Integrated CRM: Seamlessly combines with existing customer relationship management systems.

- Automated Call Routing: Efficiently directs calls to the appropriate agents to reduce wait times.

- Scalable Architecture: Easily scales to accommodate growth in call volume and data needs.

2. InsuranceDesk

- Functionality: Designed for large-scale operations, InsuranceDesk excels in robust data handling and multi-channel communication.

- Impact: Improves agent productivity and reduces call handling times, directly enhancing customer satisfaction.

- Key Features:

- Multi-Channel Support: Supports voice, email, and chat, providing a cohesive customer service experience.

- Cloud-Based Architecture: Ensures reliability and scalability while reducing IT overhead.

- Advanced Reporting Tools: Delivers detailed insights into call center operations and agent performance.

- Data Security Compliance: Meets stringent industry standards for data protection.

- Interactive Voice Response (IVR) System: Streamlines the customer journey through automated responses.

3. Convin

- Functionality: Convin integrates seamlessly with existing telephony and CRM systems to enhance contact center operations through AI-driven conversation intelligence.

- Impact: Known for significantly boosting agent performance and enhancing customer satisfaction.

- Key Features:

- Automated Quality Management: Reviews 100% of interactions to ensure high service quality.

- Real-Time Agent Assistance: Provides live support and guidance to agents during customer calls.

- High Transcription Accuracy: Utilizes advanced speech-to-text models for precise transcriptions.

- Comprehensive Analytics Dashboard: Offers deep insights into customer interactions and agent performance.

- Personalized Agent Coaching: Uses AI to identify coaching needs and tailor training sessions.

4. GlobalInsure

- Functionality: GlobalInsure specializes in delivering tailored solutions for life insurance call centers, with advanced claim processing tools and policy management features.

- Impact: Optimizes the management of life insurance queries and claims, improving both operational efficiency and customer trust.

- Key Features:

- Claim Processing Automation: Streamlines the entire claims lifecycle from initiation to settlement.

- Policyholder Portal: Allows customers to manage their policies online, reducing call volume.

- Fraud Detection Algorithms: Enhances security by detecting and preventing fraudulent claims.

- Multi-Language Support: Accommodates a global customer base with multiple language options.

- Mobile Accessibility: Ensures agents and customers can interact via mobile devices.

5. SecureCall

- Functionality: SecureCall focuses on providing robust security features and compliance tools for insurance call centers, ideal for handling sensitive information.

- Impact: Strengthens customer trust by ensuring data security and regulatory compliance, which is crucial for insurance providers.

- Key Features:

- End-to-End Encryption: Safeguards all communications between clients and the call center.

- Compliance Tracking: Keeps track of all interactions to ensure compliance with industry regulations.

- Secure Data Storage: Utilizes encrypted databases to protect customer information.

- Agent Authentication: Implements strong authentication measures to secure access to customer data.

- Regular Security Audits: Conducts audits to improve security measures continuously.

6. ClaimHandler

- Functionality: ClaimHandler offers specialized software designed to expedite the claims process within insurance call centers. It integrates seamlessly with existing systems for a unified approach.

- Impact: Accelerates the resolution of claims, significantly reducing the time customers need to wait for their issues to be resolved, thereby enhancing customer satisfaction.

- Key Features:

- Automated Claims Routing: Directs claims to the appropriate handler based on type and urgency.

- Integrated Communication Tools: Facilitates communication between departments to speed up claims processing.

- Dynamic Workflow Management: Adapts processes in real-time to handle high volumes or complex cases.

- Detailed Analytics: Provides insights into claims patterns and processing efficiency.

- Customer Self-Service Options: Reduces workload on agents by allowing customers to track claim status online.

7. PolicyStream

- Functionality: PolicyStream focuses on comprehensive policy management with features that support updates, renewals, and customer service interactions within the insurance sector.

- Impact: It improves operational efficiencies by automating policy management tasks, allowing agents to focus more on customer interactions.

- Key Features:

- Policy Automation: Streamlines the creation, adjustment, and renewal of policies.

- Customer Portals: Enables customers to manage their accounts and interact with service representatives online.

- E-Signature Capability: Facilitates the digital signing of documents, speeding up the policy handling process.

- Integrated Payment Processing: Allows for secure and direct payment options within the call center software.

- Real-Time Updates: Keeps both agents and customers informed with the latest changes or notices.

8. InsureSupportPro

- Functionality: InsureSupportPro is tailored for supporting insurance customer service with tools that enhance interaction across multiple channels.

- Impact: Boosts agent productivity and enhances customer experience by providing a unified platform for handling all customer interactions.

- Key Features:

- Omnichannel Support: Unifies communications across phone, email, chat, and social media.

- Customer Relationship Management (CRM) Integration: Enhances customer profiles with interaction history and personal details.

- Advanced Call Distribution: Efficiently manages incoming calls to reduce wait times and evenly distribute workload.

- Performance Monitoring: Tracks agent performance and customer satisfaction metrics.

- Interactive Dashboards: Offers real-time insights into call center activity and customer feedback.

9. AssureLink

- Functionality: AssureLink links insurance agents with customers through advanced telecommunication features and robust CRM integrations.

- Impact: Enhances the connectivity between agents and clients, improving communication and increasing customer retention.

- Key Features:

- Voice AI Capabilities: Utilizes voice recognition to streamline call handling and provide personalized customer interactions.

- Client Journey Tracking: Monitors and records the customer's journey to tailor services and offers.

- Automated Feedback Collection: Gathers and analyzes customer feedback immediately post-call.

- Customizable Interfaces: Allows to personalize user interfaces to suit specific operational needs.

- Disaster Recovery Systems: Ensures call center operations can continue seamlessly under any circumstances.

10. ConnectureInsure

- Functionality: ConnectureInsure is designed for insurance agencies focusing on enhancing connectivity and streamlining internal and customer communication.

- Impact: A more cohesive and efficient operation is facilitated, improving customer service and agent satisfaction.

- Key Features:

- Cloud-Based Infrastructure: Offers flexibility and scalability without significant upfront investment.

- Integrated Multichannel Communication: Ensures consistent service across all customer contact points.

- Data-Driven Insights: Harnesses data analytics to optimize customer interactions and operational strategies.

- Security and Compliance Tools: Maintains high data security standards and meets industry compliance requirements.

- Customizable Workflows: Adapts to the specific needs of the insurance agency to maximize efficiency.

These solutions, tailored to the specific needs of the insurance industry, offer diverse functionalities that enhance customer service capabilities, streamline operations, and improve overall efficiency and customer satisfaction in insurance call centers.

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

How to Successfully Deploy Insurance Call Center Software?

Deploying call center software tailored for the insurance industry involves a structured approach to ensure it aligns perfectly with company objectives and elevates customer service capabilities. Each step of the deployment process is crucial, from assessing needs to continuous optimization post-integration.

1. Needs Assessment: Tailoring Software to Specific Requirements

- Purpose: The initial and perhaps most critical step, needs assessment, involves identifying your call center operations' unique challenges and requirements.

- Process:

- Identify Key Performance Indicators (KPIs): Determine what metrics are crucial for your call center, such as call handling time, first call resolution, customer satisfaction scores, and more.

- Gather Input from Stakeholders: Include feedback from agents, managers, and IT staff who will interact with the software daily.

- Assess Volume and Scalability Needs: Consider both current call volumes and future growth to ensure the software can scale appropriately.

- Example Use Case: A life insurance call center may require software that integrates well with their existing CRM systems, supports secure data handling for compliance, and offers advanced reporting features to monitor agent performance and customer interactions effectively.

2. Vendor Selection: Choosing the Right Partner

- Purpose: Selecting a vendor is about finding a partner who not only provides software but also understands the nuances of insurance call center operations.

- Process:

- Evaluate Vendor Expertise in Insurance: Look for vendors with experience in the insurance sector, understanding its regulatory and operational complexities.

- Check for Customization and Integration Capabilities: The software should integrate seamlessly with existing systems and be customizable to adapt to specific business processes.

- Review Support and Service Agreements: Ensure that the vendor provides adequate training and support. Service level agreements (SLAs) are crucial for operational continuity.

- Example Use Case: An insurance call center vendor might be chosen for their proven track record with call center insurance entities, offering both cloud-based and on-premise solutions that allow for flexible deployment options according to the company's IT infrastructure.

3. Training and Onboarding: Empowering Users

- Purpose: Effective training ensures that all users are competent in using the new software and can leverage its features to improve performance and customer satisfaction.

- Process:

- Develop Comprehensive Training Programs: Include both technical training on software use and contextual training on how it applies to specific job roles.

- Utilize Mixed Learning Tools: Implement various training methods such as in-person workshops, online tutorials, and hands-on sessions.

- Monitor Learning Progress: Use assessments to gauge understanding and readiness to use the software efficiently.

- Example Use Case: For a call center for insurance agencies, training might include role-playing scenarios that reflect typical customer interactions, helping agents understand how to navigate the software while managing real-life situations effectively.

4. Integration: Seamless Technological Cohesion

- Purpose: Proper integration ensures that the new software works seamlessly with existing systems, enhancing rather than disrupting current processes.

- Process:

- Technical Assessment: IT teams should conduct a thorough assessment to ensure compatibility between the new software and existing hardware and software.

- Data Migration: Safely migrate data to the new system, ensuring data integrity and security.

- System Configuration: Configure the software to match business processes and integrate with other tools like email, live chat, and customer databases.

- Example Use Case: An insurance call center might integrate the new software with their existing customer relationship management (CRM) system to provide agents with comprehensive customer insights during calls, enhancing the customer experience.

5. Monitoring and Optimization: Continuous Improvement

- Purpose: After deployment, ongoing monitoring and optimization are essential to maximize the software’s impact on operations and customer service.

- Process:

- Performance Tracking: Regularly review system performance and user feedback to identify areas for improvement.

- Iterative Adjustments: Make adjustments based on feedback and performance data. This might involve tweaking features, adding new functionalities, or providing additional training.

- Leverage Analytics: Use the analytics provided by the call center software to make informed decisions about staffing, workflows, and customer service strategies.

- Example Use Case: For a call center for insurance company, continuous monitoring might reveal that additional features, such as predictive dialing or enhanced call routing, are needed to handle peak periods more efficiently.

By thoroughly understanding and implementing each of these steps, insurance call centers can effectively deploy software solutions that not only meet their immediate needs but also scale with their growth, ensuring sustained improvements in customer experience and operational efficiency.

Unlocking the Advantages of Insurance Call Center Software

Implementing specialized call center software tailored specifically for insurance agencies offers a host of benefits. These advantages streamline operational processes and significantly enhance customer relationships and organizational compliance.

Below, we explore these benefits in more detail, emphasizing how they align with the unique needs of the insurance sector.

1. Improved Customer Satisfaction

Specialized call center software for insurance dramatically improves the customer experience through several key enhancements.

- Faster Response Times: By automating routine inquiries and streamlining the call routing process, these systems ensure that customer queries are addressed more swiftly, reducing wait times and enhancing overall satisfaction.

- Personalized Customer Service: Advanced software solutions can integrate with existing CRM systems, providing agents with immediate access to customer history and preferences. This enables agents to offer personalized interactions, which are crucial in sectors like life insurance call centers, where customer needs are particularly sensitive.

- Consistent Service Quality: With features like scripted responses and real-time guidance, agents can provide consistent and reliable service, strengthening customer trust and loyalty.

2. Enhanced Efficiency

The introduction of automation and intelligent routing in insurance call center services brings significant efficiency gains.

- Reduction of Manual Tasks: Automation of administrative tasks such as data entry and call logging allows agents to focus more on resolving customer issues rather than managing paperwork, which is especially beneficial in environments like call centers for insurance companies.

- Optimized Agent Allocation: Intelligent call distribution ensures that calls are directed to the most appropriate agent, optimizing workload distribution and minimizing idle time.

- Enhanced Training Tools: Some software includes training modules that help new agents get up to speed quicker, reducing ramp-up time and improving overall operational efficiency.

3. Increased Sales and Retention

Call center software is a powerful tool for driving sales and enhancing customer retention within the insurance industry.

- Identification of Sales Opportunities: Sophisticated analytics provided by these systems can help identify patterns and insights into customer behavior, suggesting opportunities for upselling and cross-selling insurance products.

- Enhanced Customer Retention Strategies: By analyzing customer interaction data, these systems help pinpoint at-risk customers, enabling proactive engagement to improve retention rates. This is particularly useful for life insurance call centers where long-term customer relationships are crucial.

- Automated Follow-ups: The software can automate follow-up tasks, ensuring that potential leads are nurtured and existing customers feel valued, further increasing the likelihood of repeat business and referrals.

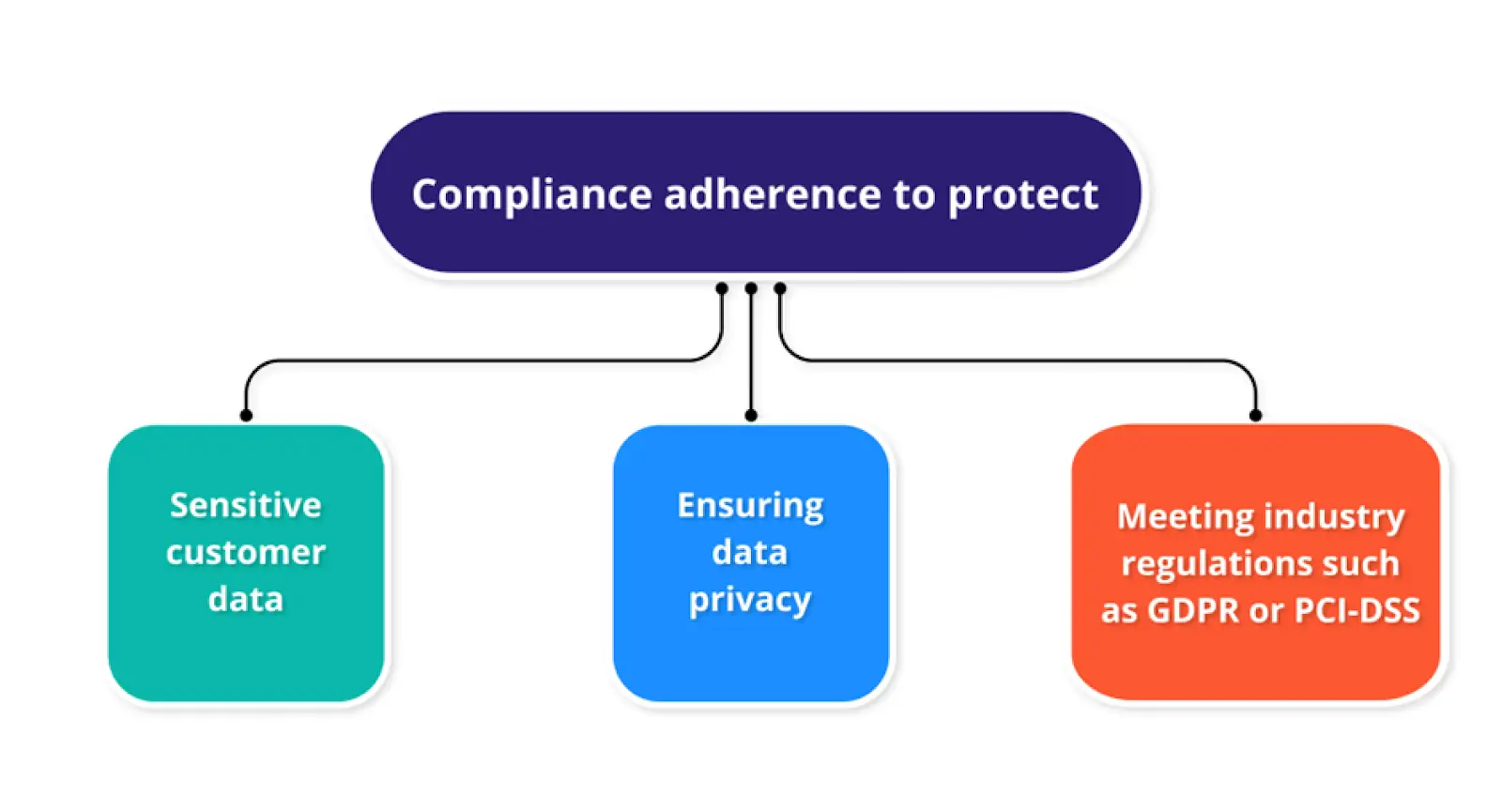

4. Compliance and Security

Compliance with regulatory standards is non-negotiable in the insurance industry, and specialized call center software helps ensure these requirements are met.

- Regulatory Compliance: Software designed for insurance call centers includes features that ensure all communications are recorded and stored in compliance with industry regulations, essential for audit purposes and legal protection.

- Data Security: Robust security measures protect sensitive customer information from unauthorized access and data breaches. This is critical for maintaining trust, particularly in call centers for insurance agencies handling personal and financial data.

- Fraud Prevention: Advanced monitoring tools can detect and alert on unusual patterns that might indicate fraudulent activity, safeguarding both the customer and the company.

The adoption of specialized call center software by insurance vendors provides transformative benefits across customer service, operational efficiency, sales, and compliance. As such, it is a strategic investment for any insurance agency aiming to modernize its customer interaction landscape and ensure a competitive edge in the dynamic insurance market.

Transforming Customer Interactions

Insurance call center software is no longer a luxury but necessary to enhance customer experience and operational efficiency. By embracing advanced technologies like Convin, insurance companies can ensure they not only meet but exceed customer expectations, securing a competitive edge in the bustling insurance marketplace.

Embracing these tools not only streamlines operations but also transforms customer interactions in the insurance industry.

Experience the impact of Convin AI solutions; Contact us to improve performance of your insurance call center today!

FAQs

1. What kind of software do call center agents use?

Call center agents typically use Customer Relationship Management (CRM) software, Automatic Call Distributors (ACD), and Interactive Voice Response (IVR) systems to manage and optimize customer interactions.

2. What is the best insurance software company?

Guidewire is often regarded as one of the best insurance software companies, providing a comprehensive suite of applications designed for property and casualty insurers to streamline operations and improve customer engagement.

3. What technology do call center agents use?

Call center agents use technologies like VoIP (Voice over Internet Protocol), CRM platforms, and workforce optimization tools to manage calls efficiently and enhance productivity.

4. What is the best calling software?

RingCentral is widely recognized as one of the best calling software options, offering robust features for voice calls, video conferencing, and team collaboration, suitable for businesses of all sizes.

5. What is insurance CRM software?

Insurance CRM software helps agencies manage client relationships, policies, and claims, with Salesforce Financial Services Cloud being a popular choice for its extensive customization options and integrations.

.avif)

.avif)

.avif)