Regulation and compliance are not just catchphrases in the U.S. banking sector—they are essential for upholding financial stability, operational safety, and consumer trust.

The bank regulatory compliance framework in the U.S. is intricate, cutting across all aspects of banking to ensure adherence to laws that mitigate risks and maintain economic resilience.

This blog examines the U.S. banking industry's regulatory and compliance framework, outlining relevant laws, governing bodies, and the processes by which institutions fulfill their regulatory compliance obligations in operations.

Master bank regulatory compliance with Convin

What is Bank Regulatory Compliance?

Bank regulatory compliance means following the laws, guidelines, and standards that govern financial institutions. It covers consumer protection, anti-money laundering (AML), cybersecurity, and financial reporting, ensuring transparency, risk management, and trust.

It has two key parts: regulators set the rules, and banks create internal systems to follow them. This dual approach protects consumers, manages risk, and upholds the credibility of the banking sector.

Bank Regulatory Compliance in the USA

Bank regulatory compliance in the U.S. safeguards stability, protects consumers, and prevents financial crimes. It’s guided by federal and state laws like Dodd-Frank (consumer protection, systemic risk), BSA/AML (anti-money laundering), and GLBA (data privacy). Oversight from the Federal Reserve, OCC, and FDIC ensures banks operate safely, follow regulations, and maintain public trust.

Regulation and Compliance Issues: Challenges and Solutions

In the banking sector, regulation and compliance are not just legal obligations—they are strategic imperatives that define trust, stability, and competitiveness. While compliance ensures protection for consumers and the financial system, it also presents operational, technological, and strategic challenges that banks must address with foresight and agility.

Challenges in Regulatory Compliance

- Changing Regulatory Scenario

Regulations evolve rapidly in response to market trends, technological innovation, and economic risks. The rise of fintech partnerships, digital currencies, and open banking frameworks has increased the pace of regulatory changes, requiring banks to constantly update policies and processes. - Complexity of Regulations

Large banks with cross-border operations must navigate both domestic and international laws, ranging from U.S. acts like Dodd-Frank and BSA/AML to global standards such as Basel III. Misinterpretation or inconsistency in applying these rules can lead to costly penalties and reputational damage. - Integration with Existing Systems

Legacy banking systems often struggle to integrate new compliance requirements, especially when they involve real-time transaction monitoring, customer identity verification (KYC), and enhanced risk assessment protocols. - Cost of Compliance

Regulatory compliance requires significant investments in technology, personnel, legal counsel, and continuous training. For smaller and mid-sized institutions, this can strain budgets and reduce operational flexibility.

- Data Privacy and Cybersecurity Risks

With the growing volume of customer data, compliance with data protection regulations like GLBA and state-level privacy laws has become increasingly complex. Cybersecurity breaches can trigger regulatory investigations and severe fines.

Solutions to Address Compliance Challenges

- Leveraging Technology

Advanced tools like AI, machine learning, and blockchain can automate compliance checks, monitor transactions for suspicious activity, and generate real-time alerts. RegTech platforms are increasingly used for automated KYC, anti-money laundering detection, and regulatory reporting, reducing human error. - Regular Training and Education

Ongoing training ensures staff understand evolving regulatory compliance requirements, can spot early warning signs of non-compliance, and respond effectively. Interactive learning modules, compliance simulations, and knowledge assessments can help teams stay proactive. - Strategic Planning and Risk Management

Banks should treat compliance as part of their long-term business strategy, embedding it into every department’s KPIs. This approach fosters a compliance-first culture that goes beyond ticking regulatory boxes. - Collaboration with Regulators

Maintaining open channels with agencies like the Federal Reserve, OCC, and FDIC can provide early insights into upcoming regulatory shifts. Participating in industry working groups and public consultations can also shape more practical compliance frameworks.

- Upgrading core banking systems to cloud-based, API-driven platforms enables easier integration of compliance features, faster adaptation to new rules, and improved reporting accuracy.

Process and System Modernizati

Practical Examples in Action

- AML Overhaul: A U.S. regional bank implemented AI-powered monitoring systems after regulatory feedback, reducing false positives in suspicious activity reports by 40%.

- Cybersecurity Compliance: A national bank invested in advanced encryption and multi-factor authentication systems to comply with GLBA requirements and state-level data privacy laws.

- Proactive Regulator Engagement: A community bank partnered with the OCC during the rollout of new fair lending regulations, ensuring smooth adoption and avoiding last-minute compliance issues.

Banks that view regulation and compliance as an opportunity—rather than a burden—can turn these requirements into a competitive advantage. By adopting a proactive, technology-driven, and collaborative approach, financial institutions can remain compliant, reduce operational risk, and strengthen customer trust.

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

How Convin Upholds Regulation and Compliance Standards

Convin’s regulation and compliance framework encompasses various legal and regulatory standards that govern data protection, software development, and business operations.

For Convin, regulatory compliance involves adhering to industry-specific regulations such as:

- General Data Protection Regulation (GDPR)

- Health Insurance Portability and Accountability Act (HIPAA)

Convin stays vigilant about regulation and compliance issues by continuously monitoring changes in legal and regulatory landscapes, ensuring its practices and products remain compliant.

- Regular Audits: Conducting regular compliance audits to identify and rectify potential compliance gaps.

- Employee Training: Providing ongoing training about maintaining compliance, especially in areas critical to Convin's operations.

Convin prioritizes compliance not just for legal obligations but also to build trust, mitigate risks, enhance reputation, and provide reliable services to its clients.

Agent Assist revolutionizes regulatory compliance and operational efficiency in the banking sector, enabling banks to meet and exceed stringent requirements through practical use cases.

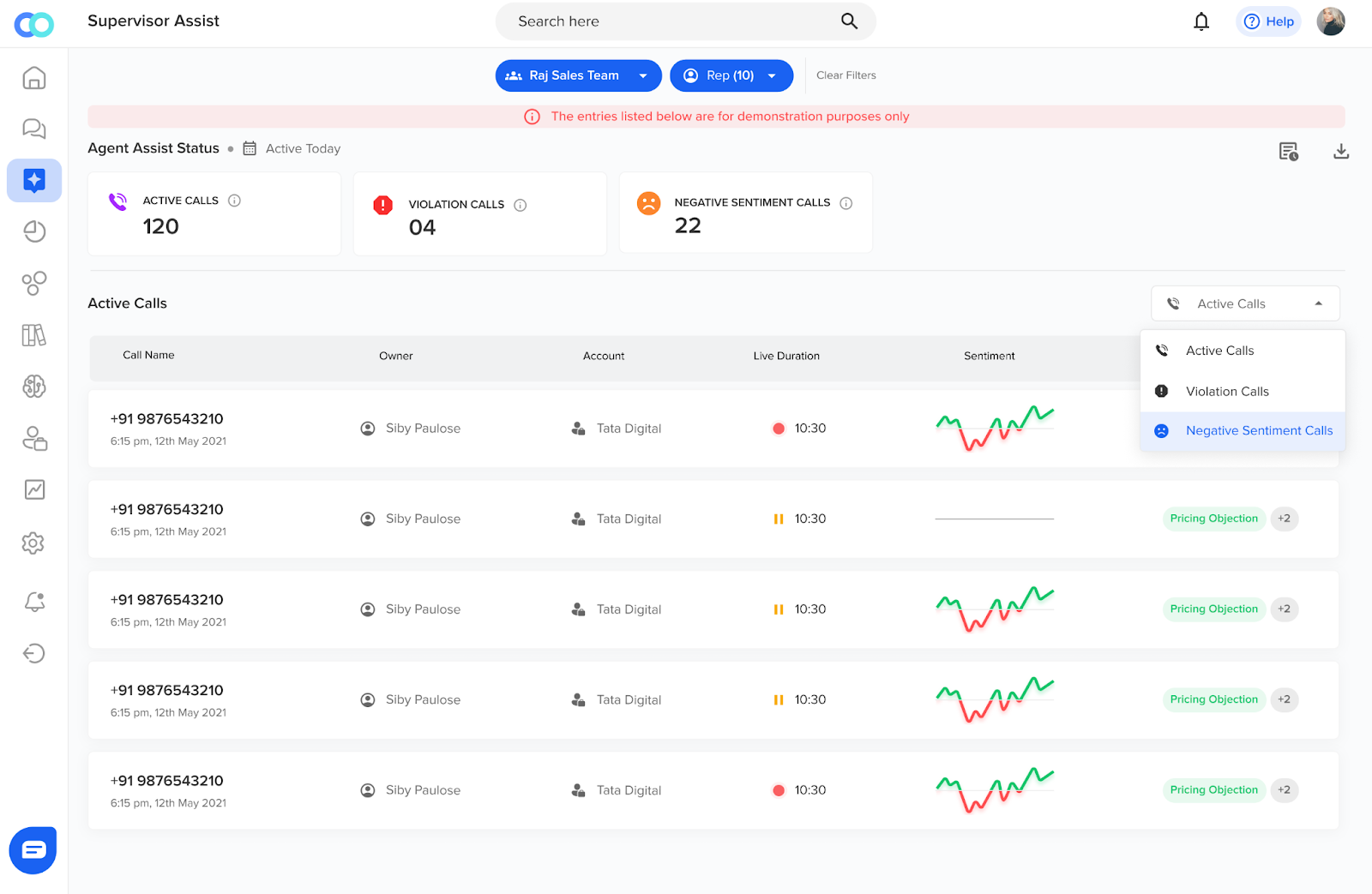

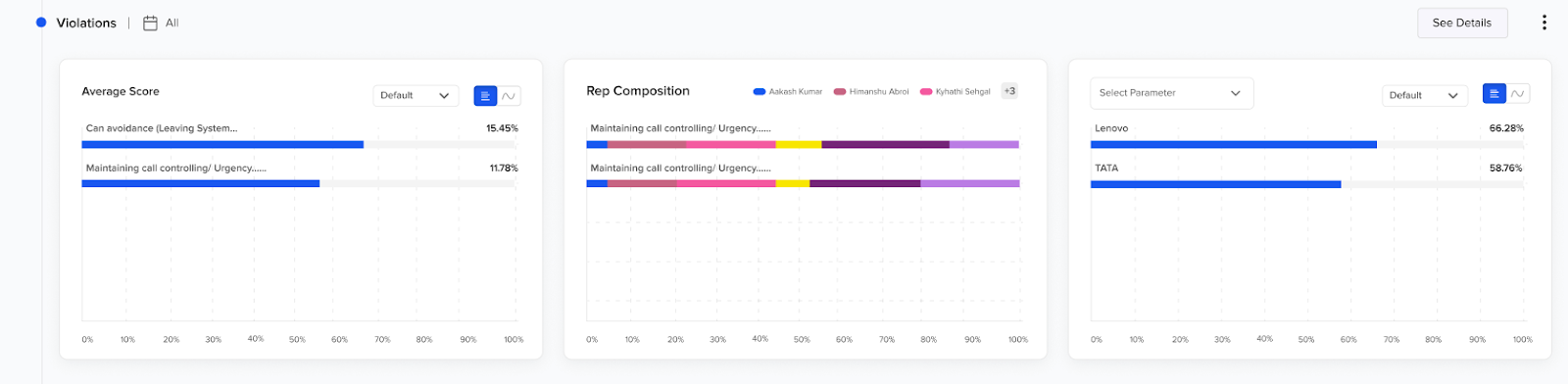

Supervisor Assist provides managers with real-time tracking of agent performance and open calls. The manager receives real-time notifications wherever violations occur.

Convin’s Outstanding Features that Help Maintain Bank Regulatory Compliance

- Enhancing Customer Service Compliance

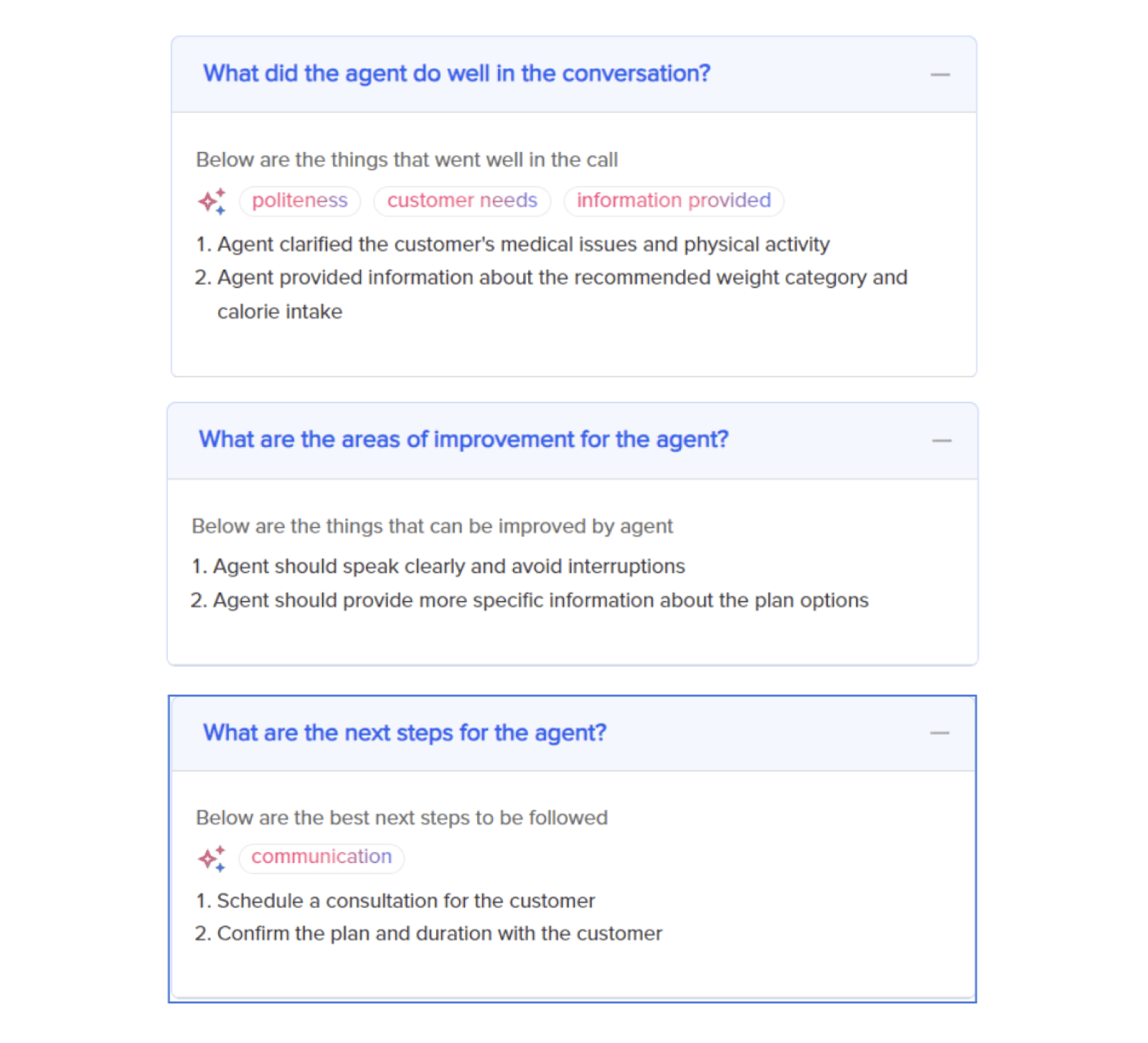

Use Case: Agent Assist technology can guide bank representatives in real-time during customer interactions, ensuring that all communications adhere to regulations and compliance standards.

- Streamlining Compliance Training

Use Case: Through interactive and AI-driven training modules, Agent Assist can offer personalized training experiences for bank employees, focusing on regulation and compliance in operations. This hands-on approach ensures that staff is well-versed in compliance regulations, enabling them to apply this knowledge effectively in their daily tasks.

- Automating Compliance Monitoring

Use Case: Agent Assist tools can monitor transactions and communications in real-time, flagging potential regulatory and compliance issues as they arise. This immediate feedback allows banks to address compliance concerns swiftly, thereby reducing the risk of regulatory infractions.

- Facilitating Regulatory Reporting

Use Case: Due to the complexity of regulatory compliance requirements, banks require efficient methods for compiling and reporting data to regulatory bodies. Agent Assist can automate the aggregation and formatting of this data, ensuring that reports are comprehensive, accurate, and submitted on time.

- Supporting Risk Management

Use Case: Identifying and mitigating risk is paramount in business regulation and compliance. Agent Assist technologies can analyze vast amounts of data to identify patterns or anomalies indicative of potential risks, enabling banks to implement corrective measures proactively.

Building Trust Through Bank Regulatory Compliance

At Convin, our dedication to regulation and compliance extends beyond mere adherence to legal requirements; it is woven into the very fabric of our operational ethos.

Convin's approach to regulation and compliance in operations is comprehensive. We ensure that every aspect of our business aligns with the highest standards of integrity and security.

By proactively addressing regulation and compliance issues, we mitigate risks and fortify our commitment to delivering exceptional value to our customers.

Engage with Convin today and experience the difference a commitment to regulation and compliance can make in your business journey.

Frequently Asked Questions

1. What regulations do US banks have to comply with?

U.S. banks must adhere to regulations such as the Dodd-Frank Act, the Bank Secrecy Act, and the Federal Reserve’s rules.

2. What are the regulatory requirements of banks?

Laws and rules ensuring financial stability, consumer protection, risk management, and anti-money laundering compliance.

3. What is the basic regulatory compliance?

Following legal, ethical, and operational standards set by governing authorities.

4. What are the three types of compliance?

Regulatory compliance, corporate compliance, and third-party compliance.

5. What are the 7 P's of banking?

Product, Price, Place, Promotion, People, Process, Physical evidence.

.avif)