Debt recovery can often feel overwhelming, especially when traditional methods fall short and produce the same disappointing results. For call center collection heads, the struggle is all too familiar: unresponsive debtors, stalled negotiations, and mounting pressure to achieve recovery targets. What if the answer lies in unexplored approaches that truly deliver measurable impact?

In this guide, Unlocking 50 Untapped Debt Recovery Solutions [+One Extra Tip], we uncover fresh, practical strategies designed to overcome these challenges. These are not recycled ideas but actionable techniques tailored to improve recovery rates and strengthen financial outcomes.

It’s time to break through barriers, optimize your process, and transform unresolved accounts into successful collections.

Track recovery progress with Convin’s performance dashboards.

Why Debt Recovery Solutions Are Essential?

Debt recovery solutions are essential because they provide businesses with structured methods to secure outstanding payments while preserving financial stability.

In today’s competitive environment, relying on outdated practices can hinder recovery efforts and negatively impact cash flow.

Effective debt recovery solutions help organizations streamline processes, reduce write-offs, and improve debtor communication without escalating conflicts. For call center teams, these solutions also provide clarity, efficiency, and measurable outcomes, ensuring that every effort contributes to achieving recovery targets.

By adopting innovative approaches, businesses not only recover funds faster but also build a sustainable framework for long-term financial health and operational success.

Accelerate recovery through Convin’s AI-powered call reviews!

50 Debt Collection Techniques You've Overlooked

Studies indicate that while most customers respond favorably to phone calls or letters, 24% prefer communication via email or SMS.

However, it’s important to understand what medium your customers prefer to be contacted through. The harsh truth is — trial and error.

So, we’re here to share 51 strong techniques to find out the best strategy for you. Let’s dive in:

Understanding Customer Information

- Behavioral Analysis: Use data analytics to understand debtor behavior patterns. By analyzing past payment behaviors, you can tailor your approach to each debtor, increasing the chances of successful debt recovery.

For example, if a debtor is more responsive at certain times of the month, schedule your calls and messages accordingly.

- Empathy Training: Train your agents to show genuine empathy. This involves understanding the debtor’s situation and expressing concern, which can build trust and encourage cooperation. Empathetic interactions can lead to more amicable resolutions and long-term relationships.

Download our free empathy statements checklist.

- Psychological Triggers: Utilize psychological triggers like social proof and authority to encourage repayment. For instance, informing debtors that others in similar situations have successfully cleared their debts can motivate them to do the same. Highlighting your authority and experience in debt collection can also prompt action.

- Cultural Sensitivity: Be culturally sensitive in your approach. Understanding and respecting cultural differences can improve communication and make debtors more receptive to repayment plans.

- Transparent Communication: Maintain transparency in all communications. Clearly explain non-payment's terms, conditions, and consequences to build trust and encourage compliance.

- Scenario Planning: Help debtors plan for various scenarios. Discuss what they can do if their financial situation changes, providing them with contingency plans that include continued debt repayment.

- Psychological Contracts: Establish psychological contracts by setting clear, mutual expectations. Debtors are more likely to honor their commitments when they agree to fair and reasonable terms.

Crafting a Debt Recovery Strategy

- Gamification: Implement gamified systems for debtors, rewarding timely payments with points or benefits. Creating a sense of achievement and competition can motivate debtors to stay on track with their payments. Consider developing a mobile app that tracks their progress and rewards them for milestones.

- Micro-Payments: Offer micro-payment options that break down the debt into small, manageable amounts. This approach can make the debt seem less overwhelming and more feasible. For instance, allow payments of as little as $5 to $10 to keep the debtor engaged and gradually reduce the debt.

- Debt Settlement Offers: Proactively offer debt settlement deals early in the debt collection process. By proposing a lump-sum payment lower than the total debt, you can incentivize debtors to settle quickly, which can be more cost-effective than prolonged collection efforts.

- Financial Counseling: Provide access to financial counseling services. Helping debtors better understand and manage their finances can lead to more consistent payments. Partner with financial advisors to offer free or discounted budgeting, debt management, and credit repair sessions.

- Customized Payment Plans: Develop customized payment plans based on the debtor’s financial situation. Flexibility in terms can make repayment more manageable and reduce defaults. Dialogue with the debtor to create a plan that works for both parties.

- Text Message Reminders: Send polite and timely reminders about upcoming payments. Text messages have high open rates and can serve as a gentle nudge for debtors to stay on top of their payment schedules.

- Incentive Programs: Create incentive programs for debtors who consistently make timely payments. Rewards could include interest reductions, fee waivers, or even small gift cards, which can encourage continued compliance.

- Debt Forgiveness Plans: Introduce partial debt forgiveness plans for those who demonstrate genuine effort in making payments. This can motivate debtors to pay more consistently, knowing that a portion of their debt will be forgiven after reaching specific milestones.

- Legal Threat Awareness: Educate debtors about the potential legal consequences of non-payment without being threatened. Providing clear information about what could happen if they ignore their debts can prompt action without damaging the relationship.

- Third-Party Mediation: Offer third-party mediation services to help negotiate repayment terms. A neutral mediator can facilitate discussions and help reach mutually agreeable solutions, especially in contentious cases.

- Regular Follow-Ups: Schedule regular follow-ups to maintain contact and remind debtors of their obligations. Consistent communication can keep debt recovery top of mind and prevent debts from being forgotten or ignored.

- Debt Swaps: Offer debt swaps where debtors can trade one type of debt for another with different terms. This can provide a more manageable repayment structure and reduce the psychological burden of high-interest debts.

- Collaborative Negotiations: Approach debt recovery as a collaborative effort rather than a confrontation. Work with the debtor to find solutions that satisfy both parties, fostering a cooperative rather than adversarial relationship.

- Debt Consolidation Offers: Suggest debt consolidation options where appropriate. Consolidating multiple debts into a single, lower-interest payment can simplify debtors' repayment processes.

- Positive Reinforcement: Acknowledge and reward small payments with positive reinforcement. Regular positive feedback can encourage continued effort and commitment to repaying the debt.

- Personalized Communication: Tailor your communication to each debtor’s preferred method and tone. Personalized interactions can increase engagement and response rates.

- Co-Signer Involvement: Involve co-signers in the debt recovery process. Informing co-signers of their responsibilities and engaging them in the repayment discussion can increase the chances of recovery.

- Flexible Payment Dates: Offer flexible payment dates that align with the debtor’s cash flow. Allowing payments on dates that coincide with their income schedule can reduce missed payments.

- Crisis Management Support: Provide support for debtors experiencing a financial crisis. Offering temporary relief or modified payment plans during hardship can build goodwill and maintain repayment efforts.

- Customized Debt Recovery Plans: Consider the debtor’s unique financial situation when creating customized recovery plans. Personalized plans can be more effective than generic approaches.

- Debt Payment Holidays: Introduce debt payment holidays where no payments are required for a short period. This can provide temporary relief and encourage future compliance.

- Long-Term Relationship Building: Focus on building long-term relationships with debtors. Offering ongoing support and maintaining open communication can lead to better outcomes.

- Community Support Programs: Collaborate with community debt recovery companies to offer debtor support programs. Community-based initiatives can provide additional resources and encouragement for debt repayment.

- Debt Repayment Challenges: Organize debt repayment challenges in which debtors compete to pay off their debts the fastest. Adding an element of competition can make the process more engaging.

Boost recovery efficiency with Convin’s smart call audits!

Leveraging Recovery Tools & Technology

- Interactive Voice Response (IVR) Systems: Use advanced IVR systems that allow debtors to interact and make payments over the phone at their convenience. These systems can also provide information on their debt status and payment history, reducing the need for agent intervention.

- Automated Payment Solutions: Implement automated payment solutions for seamless and hassle-free transactions. Providing multiple payment options, including online portals and mobile apps, can help debtors stay current on their payments.

- Educational Workshops: Host educational workshops on financial literacy. Giving debtors the knowledge to manage their finances can lead to better payment habits and reduced delinquency rates.

- Social Media Outreach: Use social media platforms to engage with debtors and provide updates on their accounts. Ensure this is done sensitively and privately to maintain confidentiality and trust.

- Debt Tracking Tools: Provide debtors with tools to track their debt repayment progress. Visual progress trackers can motivate debtors by showing how far they’ve come and how close they are to becoming debt-free.

- Mobile Payment Apps: Utilize mobile payment apps that facilitate easy and quick transactions. Integrating popular payment apps can increase the convenience of making payments for debtors.

- Digital Communication Channels: Leverage digital communication channels such as email, chatbots, and secure messaging. Providing multiple ways to communicate can increase debtor engagement and responsiveness.

- Incentivized Referral Programs: Develop referral programs that incentivize debtors to refer others who may need debt recovery services. Offering rewards for successful referrals can expand your reach.

- Hybrid Collection Strategies: Combine traditional and digital collection strategies. Using a mix of phone calls, emails, text messages, and digital portals can cover all bases and increase recovery rates.

- Interactive Debt Portals: Develop interactive debt portals where debtors can view their accounts, make payments, and communicate with agents. Providing a self-service option can enhance the debtor experience.

- Debt Relief Resources: Provide resources and information on debt relief options. Helping debtors understand their rights and available solutions can empower them to take action.

- Proactive Outreach: Engage in proactive outreach to identify and address potential issues before they become major problems. Early intervention can prevent debts from becoming delinquent.

- Financial Incentives for Agents: Offer financial incentives to agents for successful debt recoveries. Motivated agents are more likely to go the extra mile in assisting debtors.

- Debt Recovery Workshops: Host workshops that teach effective debt recovery strategies to your team. Continuous education can improve overall performance and introduce new techniques.

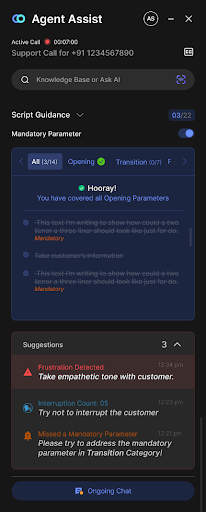

- Collaborative Technology Platforms: Use collaborative technology platforms like Convin that allow agents to work together and share best practices. Team collaboration can lead to innovative debt recovery solutions and higher success rates.

- Personalized Outreach: Personalize outreach efforts based on debtor profiles. Understanding each debtor’s unique circumstances and preferences can lead to more effective communication and higher recovery rates.

Additional Techniques

- Debt Amnesty Programs: Introduce temporary amnesty programs that waive late fees or interest for a limited period. This can motivate debtors to catch up on missed payments without the additional burden of penalties.

- Community Engagement: Engage with the debtor’s community or local support networks. Sometimes, involving a trusted third party from their community can encourage debtors to take action and repay their debts.

- Debt Forgiveness Incentives: Introduce forgiveness incentives for early or lump-sum payments. Offering a discount or partial forgiveness for early settlement can encourage debtors to pay off their debts sooner.

Bonus Tip

- Real-time Assistance: Offer real-time assistance through real-time assist software like Convin. Providing immediate support can help address debtor concerns and questions on the spot, leading to quicker resolutions and payments.

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

Strategize Your Debt Recovery Process

While these debt recovery solutions offer valuable support, it’s never too late to adopt a business-focused approach for lasting impact. With Convin, debt collection outcomes have improved by at least 17%. As regulations grow stricter and expectations rise, a reliable, effective process is essential.

Discover how Convin can transform your debt recovery journey—start today.

Frequently Asked Questions

1. What is the 11 word phrase to stop debt collectors?

When dealing with debt collectors, an effective 11-word phrase is, "I request written validation of this debt under the FDCPA." This invokes your rights under the Fair Debt Collection Practices Act, compelling the debt collector to provide detailed information about the debt to ensure its legitimacy.

2. How to fight a false debt collection?

To combat a false debt collection, request written validation of the debt. Dispute the debt in writing with both the debt collection agency and credit bureaus, providing any evidence that supports your claim. Maintaining thorough records of all communications and documentation can be crucial if the issue escalates.

3. Can you ignore debt recovery?

Ignoring debt recovery attempts is not advisable, as it can lead to legal action, increased fees, and a damaged credit score. It's better to address the situation promptly by negotiating a payment plan or disputing the debt if you believe it is incorrect.

4. What are the three things debt collectors need to prove?

Debt collectors must prove three key elements: the existence of the debt, the precise amount or outstanding balance owed, and their legal right to collect the debt. Ensuring these elements are verified protects you from paying debts that may not be valid or accurately represented.

5. How to recover a debt from an individual?

To recover a debt from an individual, start with a formal demand letter that outlines the debt and specifies payment terms. Follow up persistently with phone calls and emails to encourage repayment. If these efforts fail, consider mediation or pursuing the matter in small claims court to resolve the issue legally.

6. What is a debt collection lawsuit?

A debt collection lawsuit is when a debt collector sues a person to collect a delinquent debt. This occurs after the debt collector contacts the individual to collect debts but is unsuccessful.

![Unlocking 50 Untapped Debt Recovery Solutions [+One Extra Tip]](https://cdn.prod.website-files.com/60740020d222cb8d835a05fc/6662fd8ef6f2988b53e0d471_featured.avif)

.avif)