Banking and financial institutions operate under tight regulatory scrutiny while aggressively chasing revenue goals. This constant tug-of-war between compliance and performance often leads to missed disclosures, sales misconduct, and operational inefficiencies. AI coaching emerges as a practical solution by automating compliance while enhancing agent performance in real time, ensuring nothing slips through the cracks.

AI coaching helps banks meet compliance mandates without sacrificing sales efficiency. It delivers real-time guidance to agents, automates post-call feedback, and ensures regulatory adherence across interactions. Convin’s AI coaching platform empowers BFSI leaders with scalable solutions that reduce risk and boost performance simultaneously.

In this blog, we explore why banking leaders are turning to AI coaching to balance compliance with growth. You’ll discover key industry challenges, practical solutions, results from real case studies, and why Convin is the partner of choice for compliance-safe performance. Let’s dive in.

Unlock AI coaching with real-time agent nudges by Convin.

Why BFSI Needs AI Coaching for Compliance and Growth

BFSI organizations are juggling revenue targets with constantly evolving regulatory demands. Compliance and performance must go hand in hand to avoid business disruption and protect brand equity. AI coaching provides real-time intervention that safeguards compliance without slowing down frontline teams.

Compliance Challenges In Traditional Banking

Banking compliance has long been reactive, manual, and inefficient. Relying solely on human reviewers limits accuracy and scale. Changing regulations only compound the challenge for managers.

- Manual audits review only 1–2% of total calls, missing 98% of potential risk.

- Human fatigue and bias cause inconsistent enforcement of compliance rules.

- Supervisors lack real-time visibility into calls, delaying intervention.

- Feedback loops are too long, allowing risky behavior to persist unchecked.

Traditional methods no longer keep up with dynamic sales and regulatory demands. AI coaching for compliance empowers banks to take proactive control of every interaction. It ensures agents stay aligned with legal frameworks while focusing on customer needs.

Sales Pressure Vs. Regulatory Risk In BFSI

Sales environments in BFSI are fast-paced and aggressive, often clashing with compliance standards. Agents must deliver results under pressure, which can lead to miscommunication or regulatory oversights. Without immediate guidance, the risk of mis-selling or non-compliance spikes.

- Aggressive quotas force agents to cut corners or skip mandatory disclosures.

- Complex product portfolios confuse even experienced agents.

- Banks struggle to standardize compliance behavior across distributed teams.

- Sales success is often rewarded even when compliance is compromised.

This dangerous trade-off exposes banks to legal and reputational fallout. AI coaching dissolves this tension by offering real-time support to agents under pressure. It creates a win-win: compliant interactions that still hit revenue goals.

Now that the operational and risk tensions are clear, let’s examine how Convin directly addresses these with its outcome-driven AI coaching capabilities.

Coach faster with Convin’s agent-specific learning paths.

How AI Coaching Improves Sales Compliance with Convin

Convin’s AI coaching solution transforms how BFSI firms manage risk, train agents, and ensure regulatory safety. It blends real-time support, post-call insights, and analytics into one intelligent coaching ecosystem.

Let’s explore the different coaching types and how Convin executes them seamlessly.

Types Of AI Coaching For Banks

Banks require flexible, responsive coaching systems that cater to various agent needs and interaction types. AI coaching adapts to these demands by offering modular support across agent workflows.

- Real-Time Guidance: Offers prompts during live calls to ensure proper disclosures and script adherence.

- Post-Call Feedback: Reviews and scores calls for compliance errors, tone issues, and performance lapses.

- Role-Specific Coaching: Provides training paths personalized to each agent’s compliance behavior and sales outcomes.

- Scenario-Based Learning: Delivers simulations and playbacks of common compliance failures and how to handle them.

These types of AI coaching for banks are essential for enabling consistent agent behavior. They replace guesswork with data-backed training, allowing agents to navigate any customer situation confidently. Scalability, automation, and personalization make AI coaching far superior to traditional training methods.

Convin’s Role In AI Sales Coaching & Agent Assist

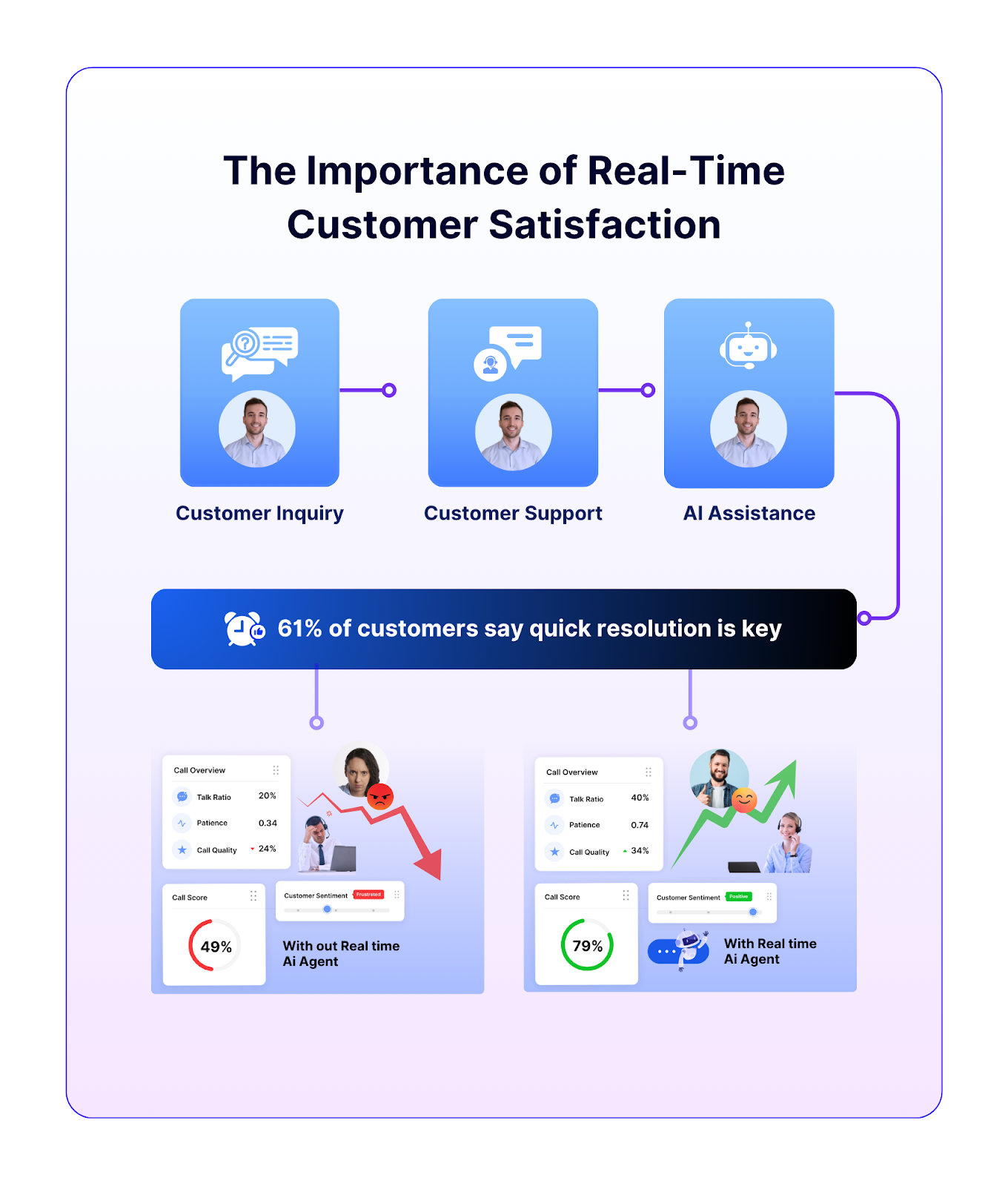

Convin’s AI engine offers real-time agent assist and post-call AI coaching with powerful analytics. It listens, detects, and prompts agents, guiding them live through complex calls while capturing compliance data.

- Live Call Monitoring: Flags if agents miss fee disclosures or deviate from approved scripts.

- Smart Nudges: Suggest following the best actions during customer interaction to course-correct in real-time.

- Performance Reports: Break down agent behavior into key metrics for managers, including talk-time, objection handling, and compliance flags.

- Customized Learning: Coaches agents post-call based on specific behavioral gaps and success trends.

This level of intelligent intervention elevates AI sales coaching from reactive to proactive. It ensures agents always act with awareness, accuracy, and regulatory consciousness. With Convin, banks can future-proof agent interactions without adding managerial overhead.

Now that we’ve explored Convin’s robust AI coaching architecture, let’s review the actual business outcomes it has delivered.

Improve disclosures via Convin’s script adherence coaching.

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

Real Results: AI Coaching Case Study In Banking Compliance

BFSI institutions using Convin have seen measurable improvements in compliance, sales, and operational efficiency. Data doesn’t lie. AI coaching leads to smarter agents, safer practices, and stronger customer outcomes. Let’s break down what this success looks like in numbers.

Performance Gains Through AI Coaching In BFSI

The shift from manual training to AI coaching is paying off across key BFSI metrics. Results are both quantitative and behavioral, showing real impact across teams and call centers.

- +15% conversion rate in under 90 days across loan and insurance verticals.

- −20% compliance breaches, including missed disclaimers and incorrect sales language.

- +25% agent satisfaction, linked to reduced stress and clearer expectations.

- 30% fewer regulatory audit escalations reported across branches.

These gains validate the transformative value of AI coaching in BFSI environments. Instead of waiting for audits to flag problems, banks now actively steer agent behavior toward excellence. AI coaching drives sustainable success while keeping risks in check.

Convin’s Data‑Backed Success In BFSI

Convin’s proprietary AI models are trained on thousands of financial interactions. This makes its coaching engine deeply contextual to BFSI-specific compliance and performance needs.

- 40% boost in compliance scores across contact centers after AI coaching integration.

- 50% reduction in manual call review time thanks to AI scoring and red-flag detection.

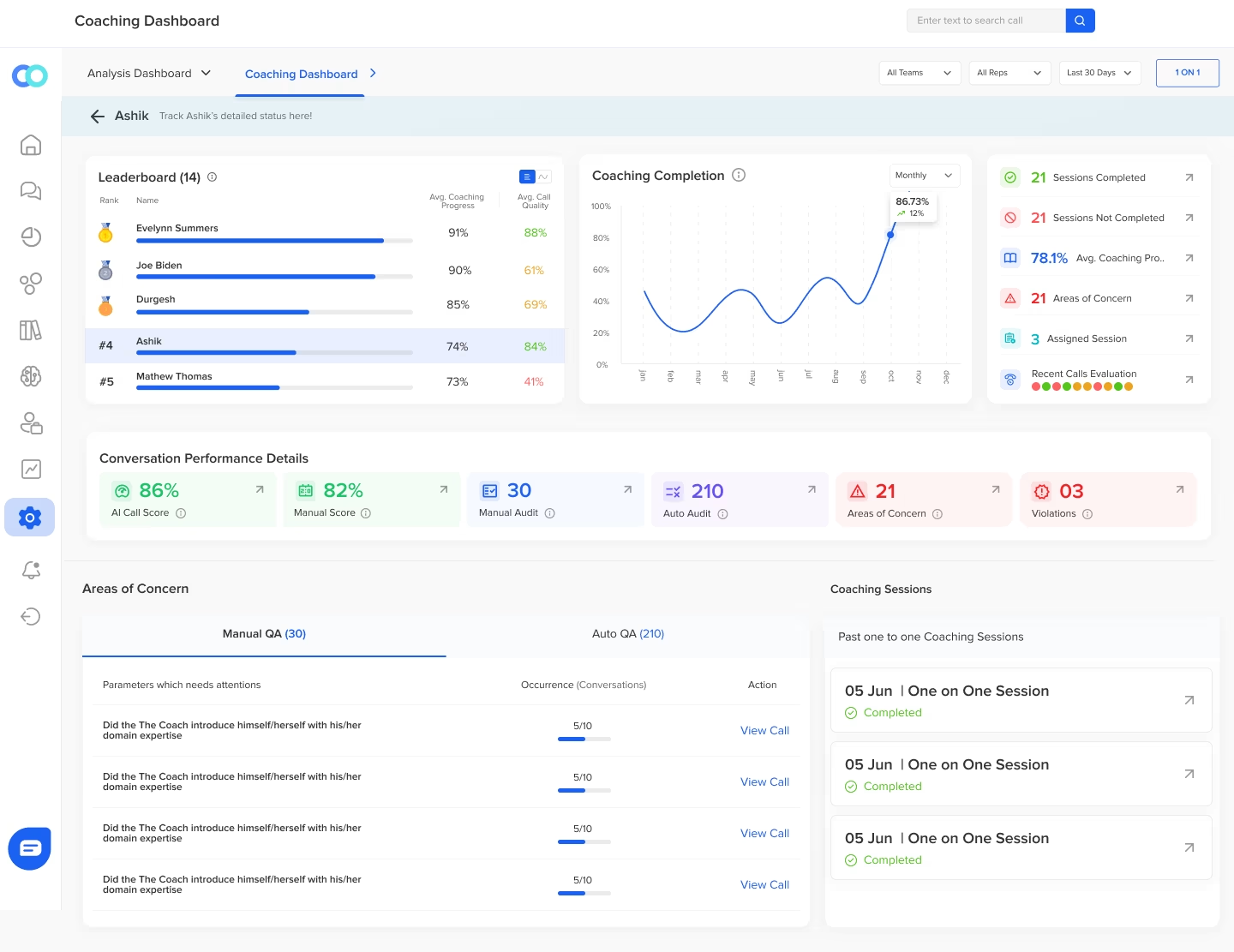

- Real-time dashboards offer VP-level visibility into agent compliance, behavior, and call quality.

- Faster onboarding and lower ramp-up time for new agents by 35%.

These outcomes show that Convin doesn’t just promise results, it delivers them, at scale and speed. AI coaching, when powered by Convin, becomes a compliance-first engine of growth.

With results in hand, let’s evaluate the risks and benefits to prepare leadership for the intelligent adoption of AI coaching.

Reduce training costs with Convin’s post-call feedback loops.

Pros And Cons Of AI Coaching In BFSI

AI coaching brings powerful upsides but must be adopted strategically. Understanding the trade-offs helps leaders align technology with regulatory strategy and operational goals. Here’s a balanced view tailored for banking executives.

Evaluating Risks And Rewards

While the benefits are compelling, any tech shift requires careful planning and stakeholder alignment. Banks must be aware of integration and regulatory considerations.

Understanding these nuances ensures a smooth rollout and faster value realization. BFSI leaders should treat AI coaching as a core compliance enabler, not just a productivity tool.

Regulatory Readiness With AI Coaching

AI coaching doesn’t just improve behavior, it protects banks during audits and inquiries. Every agent action is tracked, every disclosure logged, and every correction documented.

- Audit Trails: Comprehensive logs of agent prompts, compliance flags, and call summaries.

- Automated Reporting: Simplifies quarterly compliance reviews with regulators and board committees.

- Change-Ready Frameworks: AI models adapt to new rules, such as RBI circulars or SEBI directives.

- Data Control: Platforms like Convin offer encrypted storage and access management.

Regulatory readiness with AI coaching isn’t a bonus; it’s a necessity. Banks need systems that prevent, detect, and document risks before they escalate.

Having evaluated the balance sheet of AI coaching, it’s time to make the case for immediate executive action.

Fix risky behavior quickly with Convin’s alert workflows.

Why BFSI Leaders Must Prioritize AI Coaching Now

AI coaching is no longer a nice-to-have; it’s an essential shift for modern, compliant, growth-focused banks. Leadership teams must act before competitors and regulators dictate the timeline. This moment calls for strategic foresight and partnership.

Strategic Adoption By VPs And LOB Leaders

Leaders must lead this change from the top, ensuring clear mandates and measurable targets.

- VPs can define compliance KPIs tied to AI coaching benchmarks.

- LOB leaders use dashboards to compare team-level compliance and conversion rates.

- Adoption pilots prove ROI with low friction and quick results.

- Champions across departments can accelerate rollout and normalize usage.

Strategic adoption builds AI coaching into the organization’s DNA. It’s not a project, it’s a long-term performance and risk strategy.

Convin As A Partner For BFSI Compliance Goals

Convin understands BFSI deeply, with purpose-built tools for compliance and coaching at scale. It’s more than software, it’s a strategic transformation partner.

- Built for BFSI use cases, such as misselling compliance and regulatory scripting.

- End-to-end capabilities: onboarding, training, coaching, risk scoring, and reporting.

- AI evolves with regulation, ensuring coaching logic aligns with current legal mandates.

- Trusted by financial institutions for both front-line training and board-level reporting.

Convin ensures BFSI leaders meet today’s targets without compromising tomorrow’s audit readiness. Its AI coaching platform isn’t just smart, it’s built for your regulatory world.

AI coaching is the smart path forward for compliant, high-performing banking operations. With Convin’s platform, BFSI leaders reduce risk, sharpen sales, and future-proof customer interactions. There’s no time to wait; investing in AI coaching now secures tomorrow’s safety, speed, and scale.

Schedule a demo now!

FAQs

- Can AI coaching integrate with legacy core banking systems?

Yes, AI coaching platforms are designed to integrate seamlessly with legacy banking systems through APIs and custom connectors. - How does AI coaching influence customer trust in financial services?

AI coaching ensures consistent, compliant communication, which builds transparency and increases customer trust in banking interactions. - Is AI coaching suitable for wealth management and private banking?

Absolutely, AI coaching supports personalized, regulation-safe client conversations essential for wealth management and high-net-worth client servicing. - What role does AI coaching play in reducing internal fraud?

AI coaching monitors agent behavior and flags irregularities, helping detect and prevent internal fraud proactively.

.avif)

.avif)