First Notice of Loss (FNOL) is a pivotal moment in the insurance claims lifecycle. Traditionally viewed as an operational task, FNOL automation India revolutionizes this experience by transforming the first 120 seconds of claims reporting into a strategic sales opportunity.

Leveraging AI-powered tools such as FNOL chatbot insurance India and AI claims filing India, insurers capture emotional engagement early, converting skeptics into loyal customers while streamlining operations.

FNOL automation India is an AI-driven digital process that automates the initial claim reporting step, allowing policyholders to quickly and accurately file claims online or via chatbots.

This reduces manual work, speeds claim intake, and improves customer experience by capturing critical incident details immediately after loss. It supports multilingual interactions and integrates real-time validation to enhance accuracy and operational efficiency.

This automation transforms FNOL from a simple ops task into a seamless, empathetic sales moment that builds trust and accelerates claim resolution for insurers in India.

Convin: Where insurance meets intelligent automation.

FNOL Automation India: Transforming Insurance Claims

The FNOL process sets the tone for the entire claim journey. When FNOL automation India is implemented effectively, it shifts from cumbersome paperwork and long wait times to an efficient, empathetic experience that customers remember.

FNOL Chatbot Insurance India Empowers First Notice Interactions

AI-powered chatbots available 24/7 enable immediate, personalized claimant support. FNOL automation India connects claimants to a digitally enabled conversation that

- Reduces frustration by answering questions instantly.

- Enhances accuracy in detail capture and submission.

- Uses multilingual FNOL India insurance capabilities to overcome language barriers.

This seamless interaction increases claimant satisfaction, improving brand perception from the onset.

In conclusion, FNOL chatbot insurance India, backed by FNOL automation, offers a powerful customer-first channel, elevating the emotional response in those critical first seconds.

Digital FNOL India Insurance: Accelerating Trust and Action

Digitizing FNOL with AI claims filing in India reduces claim filing complexity and accelerates resolutions. FNOL automation India converts traditionally slow, manual steps into quick, validated, and automated data capture processes via multiple digital channels:

- Omnichannel intake (phone, app, web, chat).

- Real-time validation and integration with backend claims systems.

- Multilingual FNOL India insurance ensures effective communication across India’s diverse linguistic landscape.

By enabling quick, error-free FNOL submission, insurers build early trust and position claims as sales growth opportunities.

Thus, digital FNOL insurance facilitated by FNOL automation India minimizes claim abandonment and maximizes conversion opportunities via smooth claim initiation.

Understanding how these transformational shifts take place sets the stage for appreciating Convin’s role in delivering intelligent contact center solutions that maximize sales conversion during FNOL.

Insurance pros choose Convin for a reason. Join them.

FNOL Automation India and Convin’s Contact Center Intelligence

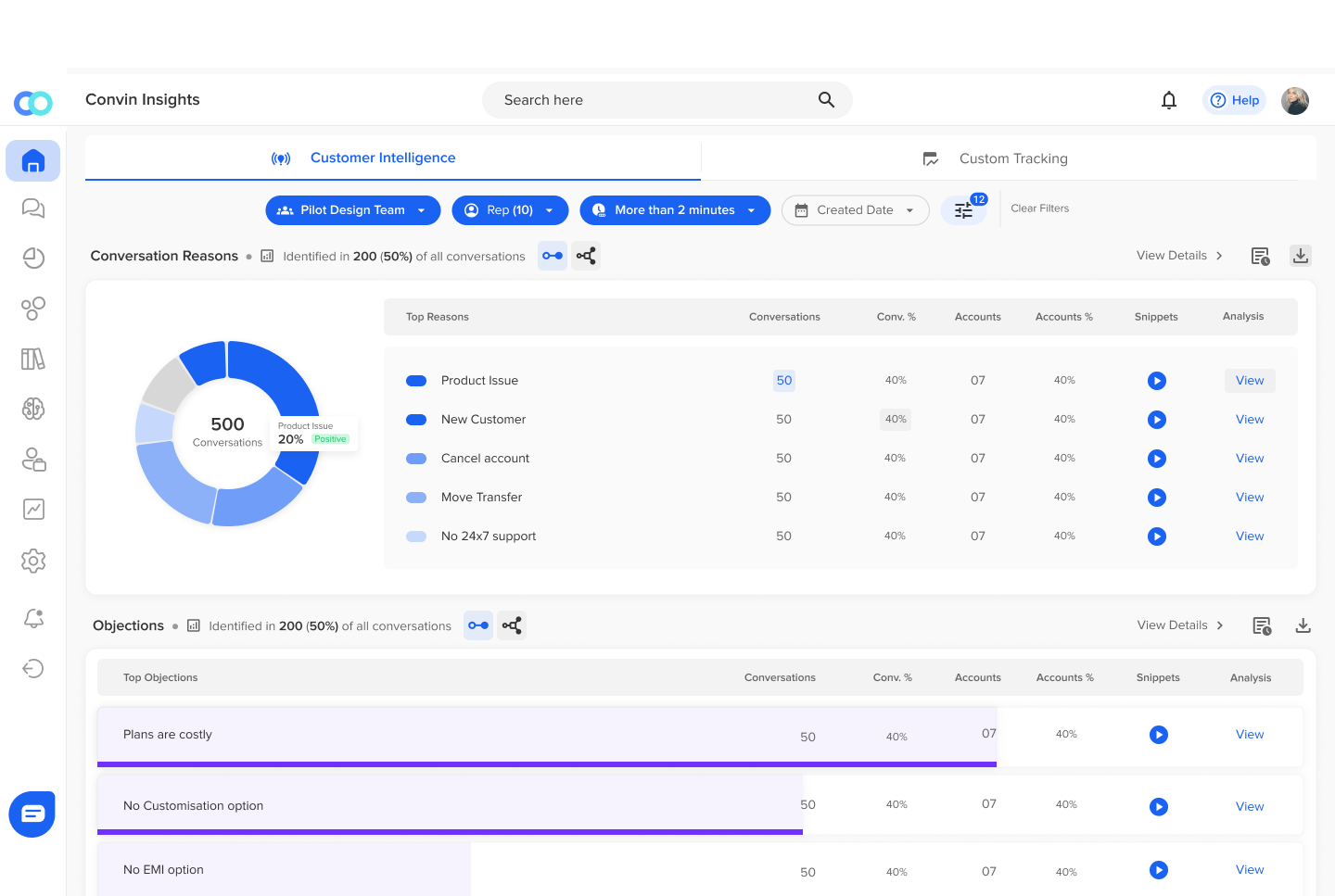

Convin’s contact center technologies enhance FNOL automation in India by turning FNOL conversations into insight-rich interactions.

Their advanced analytics and automated quality assurance platforms enable insurers to act promptly on emotional cues and conversion signals.

AI Claims Communication: Beyond Filing to Customer Conversation Excellence

By integrating Convin’s automated quality assurance tools, FNOL automation India enables:

- Real-time transcription and sentiment detection during claimant conversations.

- Conversation intelligence that highlights high-engagement and potential upsell moments.

- FNOL chatbot insurance India is equipped with AI that adapts dialogue flow based on claimant responses.

This elevates FNOL from a mechanical task to a dynamic dialogue, optimizing conversion chances.

Conclusively, Convin’s AI claims communication solutions empower insurers to personalize claim experiences, mitigating claimant doubts early and boosting brand loyalty.

FNOL Automation Solutions: Multilingual, Personalized, and Data-Driven

Leveraging Convin’s analytics, FNOL automation India delivers personalized claim handling:

- Analytics tracks conversation themes and behaviors across languages.

- Multilingual FNOL India insurance dynamically adjusts communication styles to resonate locally.

- Continuous feedback loops help improve claim scripting and claim outcomes.

This data-driven personalization forms the backbone of an optimized FNOL experience that drives both operational efficiency and customer retention.

Overall, Convin’s multilingual FNOL India insurance capabilities, combined with AI claims communication, enable insurers to scale emotional engagement across India’s vast customer base.

Comparison of Before and After FNOL Automation India and Convin’s Contact Center Intelligence

Summary:

- The transition from manual FNOL processes to automated solutions like Convin’s contact center intelligence offers over 60% faster response times, decreased error rates, and significantly enhanced customer satisfaction.

- Automation removes bottlenecks, improves data quality, and ensures claims are routed promptly, leading to quicker settlements.

- The integration of AI-powered chatbots, voicebots, and analytics elevates claim handling from a transactional task to a strategic, customer-centric engagement, driving long-term growth and operational excellence.

This comprehensive comparison underscores how automation, especially with Convin’s advanced contact center solutions, transforms claims management into a faster, more accurate, empathetic, and cost-effective process.

Transitioning from conversational quality and personalization to hard data and KPIs reveals how Convin enhances claims outcomes through measurable improvements.

Claim your wins with Convin’s AI-powered FNOL.

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

FNOL Automation India: Elevating Claim Experience with Data

FNOL automation India, powered by Convin’s contact center conversation intelligence, captures behavioral and emotional data pivotal to converting claims into growth.

AI Claims Filing India: Conversions from Conversations

- Convin-powered FNOL automation India tracks emotional triggers linked to claimant satisfaction and repeat business.

- FNOL chatbot insurance India continually gathers claimant feedback, identifying pain points in real-time.

- Digital FNOL India insurance uses AI to identify success patterns, increasing conversion rates in claims processing.

These insights allow the implementation of tailored interventions to improve sales conversion.

In essence, AI claims filing in India backed by Convin transforms conversational intelligence into actionable strategies, improving claim outcomes and customer loyalty.

Multilingual FNOL India Insurance: Emotional Impact at Scale

With India’s linguistic diversity, multilingual FNOL India insurance ensures:

- FNOL automation India personalizes claimant journeys across regional languages.

- AI claims communication captures nuanced sentiment variations to guide messaging strategies.

- Convin’s data-driven insights continuously refine FNOL messaging for maximum emotional impact across languages.

Such tailored approaches maximize customer resonance, highlighting automation’s role not just as an efficiency tool but as a growth driver.

Hence, integrating multilingual FNOL India insurance into automation reflects a mature claims strategy adapted to India’s unique market.

Effective data utilization through Convin’s analytics complements cutting-edge features that drive FNOL automation’s measurable results.

Less paperwork, more growth as Convin leads the way.

Convin’s FNOL Automation India Features & Stats

Convin equips insurers with tools that drastically improve FNOL process KPIs through advanced automation and intelligence.

FNOL Automation Solutions: Industry Data and Performance

- FNOL automation India, powered by Convin, decreases claim handling times by up to 40%.

- FNOL chatbot insurance India improves CSAT scores by providing instant, consistent claimant support.

- Multilingual FNOL India insurance expanded insurer reach and policyholder retention across India’s regions.

These quantifiable benefits demonstrate how Convin’s FNOL automation India creates tangible value.

Conclusively, Convin’s insurance automation solutions set a new benchmark for operational excellence and customer experience in the Indian insurance market.

Contact Center Conversation Intelligence: Use Cases

Convin’s conversation intelligence supports real-time, data-driven decision-making:

- Live sentiment scoring informs instant agent coaching during FNOL.

- AI claims communication identifies upsell triggers embedded in claim conversations.

- Digital FNOL India insurance provides reporting dashboards that guide strategy and training.

This technology empowers insurers to convert insights into optimized claim and sales workflows.

Thus, Convin’s intelligent contact center products form the cornerstone of a modern, conversion-centric FNOL automation ecosystem.

Book your Convin demo today!

FNOL Automation Solutions Create Lasting Moments

FNOL automation India transforms the first 120 seconds of claims into emotionally resonant, sales-converting experiences. With AI claims communication and FNOL chatbot insurance in India, insurers convert skeptical claimants into promoters. Multilingual FNOL India insurance further amplifies this effect across India’s diverse markets.

This holistic, customer-centric approach not only speeds operations but also cultivates long-term growth by connecting automation and AI that transforms insurance claims into pivotal sales moments. FNOL automation India, powered by Convin, maximizes this opportunity, building loyalty where it matters most: right at the claim’s start.

FAQs

- What are the costs of implementing FNOL automation in India for insurance companies?

Costs vary by scale, technology, and integration complexity, typically including software licensing, customization, training, and maintenance. ROI often justifies the investment by reducing operational expenses and speeding claims processing.

- How does FNOL automation India comply with Indian insurance regulations and data privacy laws?

FNOL automation India ensures compliance by incorporating data encryption, secure access controls, and adherence to IRDAI guidelines and India’s IT Act, maintaining claimant confidentiality and regulatory audit readiness.

- Which insurance companies in India are leading with FNOL automation in India adoption?

Leading adopters include ICICI Lombard, Bajaj Allianz, HDFC Ergo, and Tata AIG, leveraging FNOL automation to enhance customer engagement, reduce claim turnaround times, and improve operational efficiency.

- What are the integration challenges when deploying FNOL automation in India with legacy claims systems?

Challenges include data incompatibility, system downtime risks, and complex API configurations. Successful integration requires thorough planning, scalable middleware, and skilled IT teams to ensure seamless, real-time data synchronization.

.avif)