A majority of Indian insurance buyers don’t object because they’re uninterested; they object because they’re unsure. And that hesitation costs teams more than they realize. A new survey found that 79% of Indian policyholders are unsure whether their insurance offers adequate coverage.

That lack of clarity creates space for doubt, and without a strong rebuttal framework, it often leads to dropped deals.

This blog unpacks how to build objection-handling into your sales infrastructure. You’ll find a 4-step system to streamline responses, 10 real-world objections with contextually relevant rebuttals, and how tech, like real-time agent assist, adds structure without turning your reps into scripts.

We also explore what poor handling really costs, and how trust becomes your biggest differentiator.

If your team’s responses to “I’m not sure” still vary by rep, this is where you tighten the process and make every objection a moment worth winning.

Turn every sales objection into a clear, confident next step with AI

Why Insurance Sales Objections Are a Hidden Risk

Insurance sales in India face a trust deficit. With insurance penetration at just 3.7% of GDP, many prospects are skeptical, resistant, or disengaged.

Sales teams often navigate objections without a structure. This ad-hoc approach leads to unpredictable outcomes, broken customer experiences, and missed revenue targets.

Moreover, India’s insurance premium per capita is a mere USD 95. Clearly, the gap isn’t about products; it’s about perception and trust.

1. How Much Poor Objection Handling is Costing You?

When reps respond to objections ad hoc, the cost isn’t just lost policies; it’s erosion of trust, inconsistent conversion rates, and uneven performance across teams.

Research shows that in insurance calls, objections are frequently a signal of underlying concern, not rejection, but only 30–40 % of agents follow a structured approach to address them.

This means each mis‑handled objection can ripple: lost revenue, higher acquisition cost, and an uneven pipeline. If one rep responds confidently and another fumbles, your brand credibility suffers.

By quantifying the cost of ad‑hoc objection handling, you turn abstract frustration into a measurable risk you can remediate.

2. Why trust matters more in insurance sales

Trust isn’t optional in insurance; it’s foundational. In India, where awareness is rising but reliability perceptions lag, prospects often pause at “Who will stand behind this when it matters?” Surveys show consumers cite trust and clarity as the top blockers before purchase.

For your sales teams, that means every objection is partly a trust test. When reps listen, affirm, and provide transparency, they embed credibility. Without that, even a well‑priced product may stall.

Building trust isn’t a sideline; it’s central to converting insurance sales objections into long‑term customer relationships.

3. Conversational AI insurance tools change the game

AI tools have moved beyond hype and are now actively reshaping insurance sales. They don’t just record calls; they help reps in real time. In India and globally, insurers adopting these tools report improvements in responsiveness, personalization, and workflow efficiency.

For example, conversational AI can flag objection keywords live (“too expensive”, “need to think”), prompt the rep with a rebuttal, or escalate to a coach. That shifts objection handling from reactive to proactive.

Leveraging conversational AI insurance tools lets you standardize objection responses at scale, turning weak points into engines of consistency.

Strengthen trust now with a repeatable objection‑handling system.

A Repeatable Framework to Handle Insurance Sales Objections

Sales leaders often rely on instinct and experience to train reps, but inconsistent objection handling leads to unpredictable deal outcomes. With over 24% of Indian insurance leads lost due to mishandled objections, building a uniform response process is crucial.

1. The 4-Step Objection Handling System:

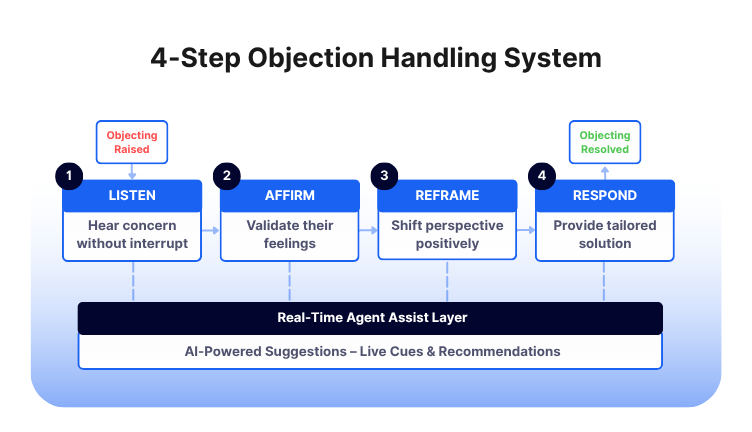

Too often, reps rely on instinct alone when facing objections. That leads to spending effort, but little consistency. A repeatable 4‑step system: Listen, Affirm, Reframe, Respond, gives structure:

- Listen – give full space to the prospect’s concern without interruption.

- Affirm – validate the concern: “I hear you, that’s valid.”

- Reframe – gently guide them to see the issue in a different light.

- Respond – provide relevant data, empathy or an example tailored to this conversation.

This framework ensures that every rep, whether new or seasoned, responds with consistency and clarity. No guesswork. No overpromising.

2. What makes rebuttals consistent and scalable?

Scaling rebuttals across dozens or hundreds of agents requires more than training slides; it requires live reinforcement and data‑driven tuning. Standardising the language of how objections are handled, paired with coaching on tone and timing, builds consistency.

On top of that, analytics matter: your tech stack should capture how each objection was handled, what worked, and what didn’t.

For instance, firms deploying conversational analytics in insurance report up to 40% reduction in operational cost by automating frontline responses and improving speed.

This kind of data allows you to identify top‑performing scripts, replicate them, and retire weak ones. When rebuttals are consistent and scalable, you remove the “wild‑card” factor from objection handling, and every rep is empowered to deliver the same high‑quality response.

3. Role of real‑time agent assist in live calls

In many Indian contact‑centres, objections happen faster than the rep can think. That’s where real‑time agent assist comes in: live cues, nudges, and suggested responses pop up during the call the moment an objection phrase is detected.

This takes the pressure off the rep scrambling for words and keeps the customer flow smooth. Recent research notes that conversational AI in insurance can reduce query response times by up to 80%.

For a Sales Enablement Head, real‑time assist is not just a nice‑to‑have; it’s a force multiplier. It ensures that even newer reps, mid‑call, can sound like seasoned pros.

With live assistance built into the call, you embed your objection‑handling framework into every conversation, shifting real‑time pressure into guided confidence.

Spot and fix costly objection gaps with structured playbooks

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

10 Common Insurance Sales Objections and How to Rebut Them

In India’s complex insurance market, objections often reflect deep-rooted concerns rather than outright rejections. From affordability to past negative experiences, each objection is a doorway to deeper conversation if approached right.

Below are the 10 most common objections Indian reps hear, and how to tackle them.

1. "I already have a policy"

Response: "That's great. Many of our clients had policies too but found better coverage or cost-efficiency after reviewing their current plan with us. Can we take 5 minutes to check if you're missing out?"

2. "It’s too expensive"

Response: "Totally understand. Most of our customers felt the same until we compared benefits vs. cost. May I show you how your current risk exposure compares with this plan?"

3. "I need to think about it"

Response: "Of course. May I ask what you'd like to think through? That way, I can provide anything you need to make an informed decision."

4. "I'm not interested right now"

Response: "That’s fair. Just curious, what would make insurance a priority for you? Sometimes timing isn’t right, but understanding the triggers helps."

5. "I don’t trust insurance companies"

Response: "You're not alone. The industry hasn’t always been transparent. That’s why we focus on showing everything upfront – charges, benefits, and terms. Would a short walkthrough help?"

6. "I need to talk to my spouse"

Response: "Absolutely. Do you think it would help if I joined that conversation or sent a summary they can review with you?"

7. "I’ve had a bad experience before"

Response: "Sorry to hear that. Would you be open to seeing how we handle claims and service differently? Just 5 minutes."

8. "Send me the information"

Response: "Happy to. So I send the right info, may I understand what you’re most concerned about – pricing, claims, benefits?"

9. "I don’t have time"

Response: "Fair. Can I send a 60-second voice note or a quick visual summary for you to glance at later?"

10. "Call me back later"

Response: "Sure. Just before I go, can I ask what you’d like to see different in our next call, more savings, faster claim process, or policy comparison?"

Rebut top insurance objections confidently with proven responses

How Conversational AI Insurance Tools Improve Objection Handling at Scale

As insurance firms in India scale digitally, tech isn’t just an enabler, it’s a differentiator. Conversational AI allows leaders to hardwire successful objection handling into every rep’s workflow.

With tools like Convin, sales orgs analyze thousands of calls, train reps using real patterns, and deliver live objection rebuttals without guesswork.

1. Real-time agent assist: Live Nudges for Handling Insurance Sales Objections

Objections often arise in the heat of a conversation before the rep is fully prepared. Real‑time assistance changes that. Platforms equipped with live monitoring can detect objection‑triggers like “too expensive” or “I’m not sure”, and instantly surface appropriate responses or prompts.

One industry study found that roughly 77% of insurers are already scaling AI deployments, using automation and live‑agent assist tools to reduce support volumes and speed responses.

Live assist tools help every rep stay aligned with best‑practice responses, turning objections into confident, structured dialogue.

2. Conversation Intelligence: Analytics for Consistent Objection Outcomes

Handling objections consistently across a team isn’t just about training; it’s about data.

Conversation intelligence platforms analyze call transcripts, track objection patterns, compare responses by rep, and highlight what works.

For example, reports show that AI adoption in Indian insurance operations can cut operational costs by up to 40% through automation and improved workflows. With analytics baked in, variability in how objections are handled drops across the board.

Analytics convert “what might work” into “what does work”, enabling repeatable objection‑handling frameworks built on evidence.

Build consistency across every rep with AI-guided objection handling

Embed a Scalable System to Master Insurance Sales Objections

Objections are part of every insurance conversation. The real risk is when reps handle them without structure; some improvise, others hesitate, and both outcomes weaken trust. In a market like India, where insurance is still misunderstood by many, these missed moments can cost more than just a sale.

For teams managing large volumes, the solution isn’t more training slides. It’s a system that helps every rep respond clearly, without losing momentum.

Convin brings that system together, real-time support during calls, insights after, and a way to fix the gaps without starting from scratch.

If objection handling still feels unpredictable, it’s time to tighten the process.

Build consistency across every rep with AI-guided objection handling

FAQ

1. How to handle objections in insurance?

Start with a structured approach: listen to the concern, affirm it, reframe the context, and respond with clarity. Inconsistent handling leads to dropped opportunities. Using conversational tools like Convin helps agents respond in real time, ensuring trust isn’t lost in the first few seconds.

2. What are the 7 methods for handling objections?

While methods vary, these are seven widely adopted techniques:

- Listen fully

- Validate the concern

- Ask clarifying questions

- Reframe the issue

- Share relevant data or examples

- Confirm understanding

- Move the conversation forward

These techniques can be embedded into live sales calls with the help of structured tools like Convin’s real-time agent assist.

3. What are the 5 steps to overcome objections?

A lean 5-step objection handling framework includes:

- Hear the full objection

- Acknowledge it respectfully

- Isolate the true concern

- Address it with facts or empathy

- Close the loop with a clear next step

4. How to deal with rebuttals in insurance?

Rebuttals should be guided, not improvised. Map common insurance sales objections and build response playbooks around them. Tools like Convin help standardize rebuttals across teams by analyzing calls, spotting objection patterns, and nudging agents with relevant responses mid-conversation.

.avif)