Predictive analytics in insurance transforms risk management with data-driven insights, driving faster, smarter decisions. Convin’s AI-powered platform amplifies this by delivering real-time agent assist, automated coaching, and quality assurance, accelerating claims and underwriting processes while enhancing compliance and policyholder satisfaction. This strategic edge is vital for future-ready carriers.

Predictive analytics in insurance uses historical and real-time data to identify patterns and forecast future outcomes. This technology enables insurers to optimize risk assessment, enhance underwriting accuracy, detect fraud, and improve customer experiences; hence, driving smarter, data-driven decisions essential for carrier growth and resilience.

Navigate economic twists as Convin helps carriers steer with data.

How Is Predictive Analytics in Insurance Transforming Risk Management?

Predictive analytics in insurance is changing risk management by transforming vast data into predictive insights that allow carriers to anticipate and mitigate risks effectively.

It combines historical and real-time data streams, providing insurance carriers the ability to forecast claims, price policies dynamically, and detect fraudulent activities with greater accuracy.

This transformation moves insurers from reactive to proactive risk management, a vital advancement in today’s volatile environment.

The Role Of Predictive Analytics In Risk Forecasting

Predictive analytics in insurance enables enhanced risk forecasting by analyzing diverse data sources such as customer demographics, claims history, credit scores, and IoT telematics.

AI insurance analytics models detect loss likelihood and flag fraudulent claims early, improving underwriting accuracy and reducing loss ratios.

- Predictive analytics in insurance lowers loss through precise forecast models.

- Insurance predictive analytics identifies suspicious claims before payouts.

- AI tools for insurance predictive analytics enable dynamic pricing adjustments.

Conclusively, insurance data analytics transforms traditional actuarial practices into forward-looking risk engines, enhancing carrier profitability and reliability.

Enhancing Predictive Modeling Insurance Capabilities

Predictive analytics software for insurance utilizes machine learning to refine risk models continuously.

- Insurance risk analytics simulates various scenarios, integrating climate, economic, and social data to adapt underwriting strategies dynamically.

This results in better capital management and regulatory compliance.

- Predictive modeling insurance adjusts policies in real time based on emerging data.

- Data analytics insurance improves catastrophe loss predictions amid climate instability.

- Insurance predictive analytics strengthens solvency and risk assessments.

Predictive analytics in insurance advances data modeling into adaptive, scalable strategies essential for modern carriers.

AI Tools For Insurance Predictive Analytics To Watch In 2025

Here is a curated list of top AI tools that leverage predictive analytics in insurance, empowering carriers to innovate in underwriting, claims, risk management, and compliance.

- Convin – An AI-powered conversation intelligence platform that integrates predictive analytics in insurance to enhance claims management, underwriting, and fraud detection.

Convin offers real-time agent assist, automated coaching, and quality assurance, reducing claims processing time by 35%, improving fraud detection accuracy by 40%, and increasing operational efficiency by over 25%.

Its platform analyzes all member communications, delivers actionable intelligence for faster decision-making, and ensures regulatory compliance while boosting policyholder satisfaction.

- SAS Viya – A cloud-based analytics suite combining AI, IoT, and predictive analytics for enhanced risk assessment, fraud prevention, and customer behavior insights.

- Guidewire Predict – Provides predictive models embedded within Guidewire’s insurance suite, supporting pricing, underwriting, and claims workflows.

- Gradient AI – Focuses on underwriting and risk scoring using machine learning to improve risk evaluation speed and accuracy.

- Tractable – Specializes in computer vision for damage assessments in auto and property claims, enabling faster and more accurate claim resolutions.

- Cape Analytics – Uses geospatial AI for property risk intelligence, supporting more precise underwriting and portfolio management.

- Compliance.ai – AI-powered regulatory monitoring that uses predictive analytics to help insurers stay compliant amid shifting regulations.

- HazardHub – Analyzes thousands of hazard factors to score geographic risk for natural disasters, improving underwriting precision.

- Cyence – AI-driven cyber risk modeling platform for underwriting cybersecurity risks and pricing policies accordingly.

- AgentFlow – Workflow automation with integrated predictive AI to boost operational efficiency and optimize insurance processes.

Top AI Predictive Analytics Tools for Insurance

Convin’s position at the top reflects its unique AI-driven conversational insights capability, driving significant efficiency and predictive power in insurance predictive analytics.

Its ability to analyze multi-channel communications and deliver real-time assistance makes it a leader for carriers aiming to scale smarter, faster, and more compliantly in 2025.

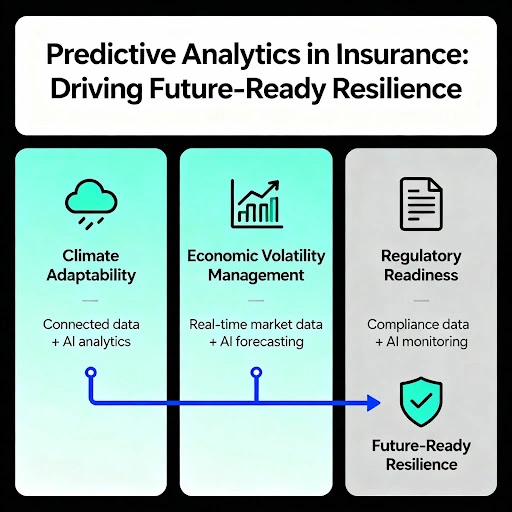

Beyond risk management, predictive analytics in insurance drives resilience against climate, economic, and regulatory challenges.

Convin: powering compliance, claims, and coaching with AI brilliance.

How Can Predictive Analytics in Insurance Drive Future-Ready Resilience?

Predictive analytics in insurance equips carriers to face future uncertainties by integrating climate data, regulatory foresight, and economic indicators.

Through AI insurance analytics, carriers can model potential threats proactively and implement strategies ensuring operational continuity and regulatory compliance.

Using Data Analytics Insurance For Climate Adaptability

Predictive analytics in insurance harnesses geospatial and environmental data to analyze climate risks, such as flooding or storms, allowing insurers to tailor coverage and reserve funds strategically.

- AI tools for insurance predictive analytics forecast weather-related risks.

- Predictive modeling in insurance integrates climate science with underwriting.

- Predictive analytics software aligns sustainability goals with financial planning.

This combination of data analytics, insurance, and climate science supports carrier durability in a warming world.

Managing Economic Volatility with Predictive Analytics in Insurance

Economic volatility poses significant challenges to insurers, impacting risk exposures, pricing strategies, and capital reserves.

Predictive analytics in insurance equips carriers to anticipate and respond to these fluctuations with precision and agility.

By analyzing macroeconomic indicators alongside internal data, insurance predictive analytics models forecast the effects of market swings on claims volume, policy lapses, and underwriting profitability.

- Predictive analytics software for insurance integrates GDP trends, inflation rates, and unemployment data into risk models.

- AI insurance analytics identifies early signals of economic stress affecting policyholders’ payment behaviors.

- Insurance data analytics supports dynamic pricing adjustments to maintain portfolio stability during economic shifts.

- Predictive modeling in insurance assists in capital allocation to buffer unexpected financial shocks.

This data-driven approach enables carriers to mitigate losses by proactively adjusting risk appetites and fostering financial resilience.

Through continuous monitoring and scenario analysis, predictive analytics in insurance transforms uncertainty into actionable insights, safeguarding carrier solvency and competitiveness amid volatile economic conditions.

Achieving Regulatory And Economic Readiness

Insurance predictive analytics automates compliance monitoring, ensuring carriers stay ahead of evolving regulatory requirements while managing financial risk amid economic fluctuations.

- Predictive analytics software reduces regulatory breaches via early warnings.

- Data analytics insurance monitors solvency and stress-testing metrics.

- Predictive modeling in insurance streamlines reporting and audit readiness.

Predictive analytics in insurance ensures that carriers not only comply with regulations but thrive economically.

Operational readiness emerges as the cornerstone of this transformation, where Convin’s solutions provide a competitive advantage.

Unlock insurance foresight with Convin!

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

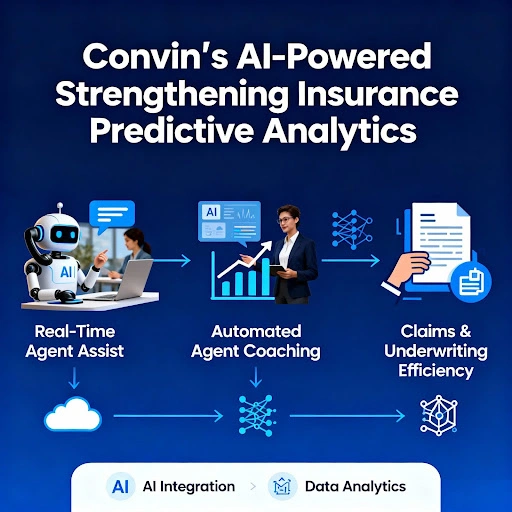

How Do Convin’s Solutions Strengthen Predictive Analytics in Insurance Operations?

Convin’s AI-powered platforms integrate seamlessly with predictive analytics in insurance, empowering carrier operations with live insights and proactive coaching to enhance accuracy and compliance.

Leveraging Convin’s Predictive Analytics Platforms for Claims and Underwriting Efficiency

Convin’s AI-driven predictive analytics platforms elevate insurance operations by integrating advanced data modeling directly into claims handling and underwriting processes.

These tools enhance efficiency by delivering real-time risk insights and automating quality assurance, transforming the carrier’s ability to manage complex workflows.

- Convin applies predictive analytics in insurance to analyze every member interaction: calls, chats, and emails for sentiment, compliance, and fraud detection.

- Predictive modeling insurance, coupled with automated agent coaching, powers faster, more accurate claims decisioning with reduced manual review.

- Real-time Agent Assist provides actionable prompts during underwriting and claims intake, aligning risk evaluation with predictive analytics software outputs.

- Automated quality assurance ensures regulatory adherence, minimizing errors and accelerating settlement times.

This integrated approach enables carriers to reduce claims processing time by up to 35%, improve fraud detection accuracy by 40%, and enhance operational efficiency by over 25%.

By embedding predictive analytics in insurance into core operations, Convin empowers carriers to deliver superior policyholder experiences while controlling risk and costs.

Convin Real-Time Agent Assist For Predictive Excellence

Convin’s Real-Time Agent Assist complements predictive analytics in insurance with during-call guidance, ensuring agents respond with precision based on predictive risk assessments.

- Real-Time Agent Assist delivers instant predictive insights to agents.

- Insurance predictive analytics integrates with CRM for unified data flows.

- Data analytics insurance balances compliance and customer satisfaction in real time.

Together, Convin and predictive analytics software optimize carrier communication and decision-making.

Automated Agent Coaching For Continuous Learning

Convin’s Automated Agent Coaching uses predictive analytics in insurance to analyze call recordings, providing targeted feedback that elevates agent performance and compliance adherence.

- Predictive modeling in insurance drives coaching algorithms, adapting to emerging patterns.

- Insurance risk analytics identifies training gaps to reduce claims errors.

- Data analytics insurance accelerates operational improvements across teams.

Convin’s coaching ensures that predictive analytics in insurance translates into frontline excellence and risk mitigation.

With operational robustness, predictive analytics in insurance now enhances policyholder experience management.

Convin’s real-time assist turns data into decisions!

What Role Does Predictive Analytics in Insurance Play in Policyholder Experience?

Predictive analytics in insurance personalizes interactions, anticipating customer needs to reduce churn and enhance satisfaction.

Leveraging insurance predictive analytics, carriers tailor offerings and resolve issues swiftly, improving loyalty and lifetime value.

Convin Solutions and Predictive Analytics Impact

Enhancing Experience Through Data Analytics Insurance

Predictive analytics in insurance informs personalized communication and proactive service actions, driven by behavioral and sentiment data analysis.

- Data analytics insurance enables targeted renewal and upselling campaigns.

- AI tools for insurance predictive analytics facilitate early issue identification.

- Predictive analytics software enhances service consistency and responsiveness.

By transforming data insights into policyholder-centric actions, carriers build durable, trust-based relationships.

Finally, predictive analytics in insurance shapes the strategic future of carriers through smart automation and adaptive intelligence.

Book your Convin demo now!

How Will Predictive Analytics in Insurance Define The Future Of Carriers?

Predictive analytics in insurance is central to building agile, resilient carriers ready for regulatory evolution and market volatility. Its integration with AI and automation technologies heralds a new era of operational sophistication and customer engagement.

Predictive analytics in insurance will evolve towards federated AI ecosystems, enabling cross-enterprise data collaboration and autonomous decision-making.

- AI insurance analytics will support end-to-end automated underwriting and claims.

- Predictive analytics software for insurance will drive global regulatory harmonization.

- Insurance data analytics will catalyze cloud-based, scalable insurance platforms.

This future-ready approach ensures carriers maintain a competitive advantage and operational excellence.

FAQs

- How long does it take to implement predictive analytics in insurance operations?

Implementation typically takes 3-6 months, depending on data readiness, system complexity, and internal alignment. Starting with pilot projects accelerates integration and validation of models before full-scale deployment.

- What are the biggest implementation challenges when adopting insurance predictive analytics?

Key challenges include data quality issues, system integration complexity, lack of skilled talent, organizational resistance to change, and ensuring regulatory compliance while maintaining transparency and unbiased models.

- How do insurers measure ROI from predictive modeling insurance initiatives?

Insurers track ROI via reduced claims processing time, improved fraud detection rates, enhanced underwriting accuracy, increased customer retention, and overall operational cost savings realized through automation and predictive insights.

- What skills should insurance teams develop to work effectively with data analytics insurance?

Teams need data literacy, understanding of AI/ML concepts, domain expertise in insurance products, analytical thinking, and competency with predictive modeling tools to harness data-driven decision-making.

- How often should AI tools for insurance predictive analytics models be retrained or updated?

Models should be updated quarterly or semi-annually, or sooner in rapidly changing environments, ensuring accuracy amid evolving data patterns, regulatory changes, and emerging risk factors.

%20BLOG10%20examples%20of%20artificial%20intelligence%20in%202024.webp)

.avif)