In the complex world of modern insurance, a claim isn't just paperwork, it’s a vulnerable moment for the policyholder. With customer satisfaction dropping to a seven‑year low amid longer claims cycles and massive storm losses, the way insurers handle this interaction heavily influences loyalty.

This blog explores how empathy and technology together shape a superior insurance customer experience.

You’ll see why the emotional stakes of the claims journey matter, how delayed or opaque steps erode trust, and how seamless post claim feedback amplifies value.

You’ll also learn how automation tools, from live agent assistance to voice‑of‑customer analytics, can fix key gaps and elevate claim satisfaction insurance at scale.

Read on to uncover how leaders are redesigning the claims journey experience into a trust‑building asset, not a liability, and how one unified solution aligns empathy and efficiency for real insurance customer experience wins.

Boost claim trust and speed, transform your CX with Convin today.

Why Empathy Matters in the Insurance Customer Experience

When a policyholder files a claim, it’s far more than a transaction, it’s a moment of vulnerability. They’re trusting their insurer to deliver when it matters most.

If the claims process drags, confusing steps stack up and fear or frustration sets in, trust begins to erode.

For modern insurers, the path to a better insurance customer experience lies in acknowledging that emotional weight, then using automation to simplify, clarify, and restore confidence at every turn.

1. Emotional Weight of The Claims Journey Experience

Policyholders expect clarity and speed when lodging a claim. Studies show that a poor claims journey experience often leads to churn, one report found 77% of dissatisfied claimants considered switching insurers.

When every step feels manual, opaque or slow, it amplifies stress at a moment when customers are already distressed. The right journey design acknowledges the emotional stakes, guiding the claimant with transparency and compassion.

Designing with empathy turns the claims journey experience into a trust‑builder rather than a liability.

2. How Claim Satisfaction Insurance Begins With Human Understanding

Claim satisfaction insurance isn’t just about speed or payment, it’s also about how the customer feels heard and respected.

Clear updates, real‑time status, and human‑tone communication matter more than ever. According to a digital claims study, satisfaction rose by 17 points when mobile apps let customers report losses and view updates.

When the insurer treats the claimant like a person in need, not a file number, satisfaction follows. Conclusion: The foundation of claim satisfaction insurance is the human connection, tangible, empathetic, timely.

3. Role of Post Claim Feedback In Capturing Emotional Moments

Post claim feedback is not optional, it provides insurers with the emotional pulse of the moment when service delivery is most critical.

By inviting feedback immediately after claim resolution, insurers capture raw responses: was the process clear? Was the agent empathetic? Did the claimant feel respected? Those insights feed the continuous improvement of the claims journey experience and boost overall insurance customer experience.

Post claim feedback turns emotion into actionable data and elevates trust for the next interaction.

But even with good intentions, gaps in execution often dilute empathy. These cracks in the claims process are where trust quietly slips away.

Capture feedback that builds trust, power it with Convin

Gaps in Today’s Claims Journey Experience

Despite rising expectations, many insurers still rely heavily on manual touchpoints in the claims flow. That means delays, opaque status updates, mis‑communications and recap errors.

These gaps are not just operational, they strike at the heart of the insurance customer experience. When policyholders feel lost or uninformed, trust dims. Identifying and closing these gaps is critical.

1. Manual Claims Slow Down Satisfaction And Trust

Manual workflows in claims processing often introduce unwanted wait times, error risk and customer frustration. In 2025 U.S., one report flagged that homeowners insurance claims satisfaction hit friction due to long repair cycle times and high volume of catastrophic events.

Slow follow‑up, unclear next steps and unclear ownership all contribute to a degraded claims journey experience.

Reducing manual dependencies is key to avoiding trust erosion in the claims process.

3. Missed Opportunities In Post Claim Feedback Loops

When insurers skip the feedback invitation or fail to act on it, they miss a strategic window into the policyholder’s emotional state. Without a closed loop, feedback gathered, data analysed, actions taken, claim satisfaction insurance remains reactive not proactive.

One study noted that insurers achieving the highest CX scores actively use feedback to refine processes.

Closing the feedback loop converts insight into improvement and enhances the insurance customer experience.

4. Poor Claims Journey Experience Leads to Frustration

A claims journey marred by mis‑communication, delays or multiple hand‑offs is a frustration factory. Around 50% of customers satisfied with their claims experience were likely to renew, compared with just a third of dissatisfied customers.

When policyholders feel ignored or stuck, dissatisfaction grows and risk of churn climbs. A weak claims journey experience doesn’t just cost goodwill, it costs retention.

To fix the experience, insurers need more than intent, they need systems. Automation offers the structure to support empathy at scale.

Fix claim pain points fast, automate with Convin today

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

Simplifying Claims With Automation for a Better Insurance Customer Experience

If emotional trust is the core of insurance customer experience, then automation is the enabler.

Automation removes friction: it speeds approvals, gives instant status, reduces errors, frees agents to focus on empathy rather than paperwork.

By embedding automation into the claims journey experience, insurers convert pain points into predictable delight.

1. How claims automation insurance reduces emotional friction

Automation in the claims pipeline means fewer manual hand‑offs, fewer lost forms, fewer status silences.

For example, modern intelligent automation drives up to 40% faster processing times and policyholder satisfaction increases by up to 25%.

When these systems are designed to keep the claimant informed, their anxiety drops. Claims automation insurance eases emotional friction and anchors a positive insurance customer experience.

2. Speed, Clarity, And Claim Satisfaction Insurance Via Tech

Automation delivers speed, but it also delivers clarity. Policyholders want to know where their claim stands, not just when it will resolve.

With automated notifications, clear workflow paths and mobile access, insurers meet those expectations. One consumer study found satisfaction surged when digital claims experience improved.

Speed alone isn’t enough, clarity, transparency and responsiveness make up true claim satisfaction insurance.

3. Scalable Empathy Through Claims Automation Insurance

Empathy is often thought of as a human attribute, but with automation freeing agent time, insurers can scale empathetic service rather than compromise it.

With the right tech in place, every claimant can receive prompt acknowledgement, guided next steps, and tailored support.

This scalability is what builds a reliable insurance customer experience. Claims automation insurance enables consistent, empathetic interactions across every claim, at scale.

Technology lays the foundation, but execution depends on how it’s used. That’s where Convin becomes a difference-maker in the insurance customer experience.

Empower empathetic claims at scale, start with Convin now

Convin’s Role in Transforming Insurance Customer Experience

For executives driving customer‑centric growth, Convin presents a practical platform bridging empathy and automation in claims and service.

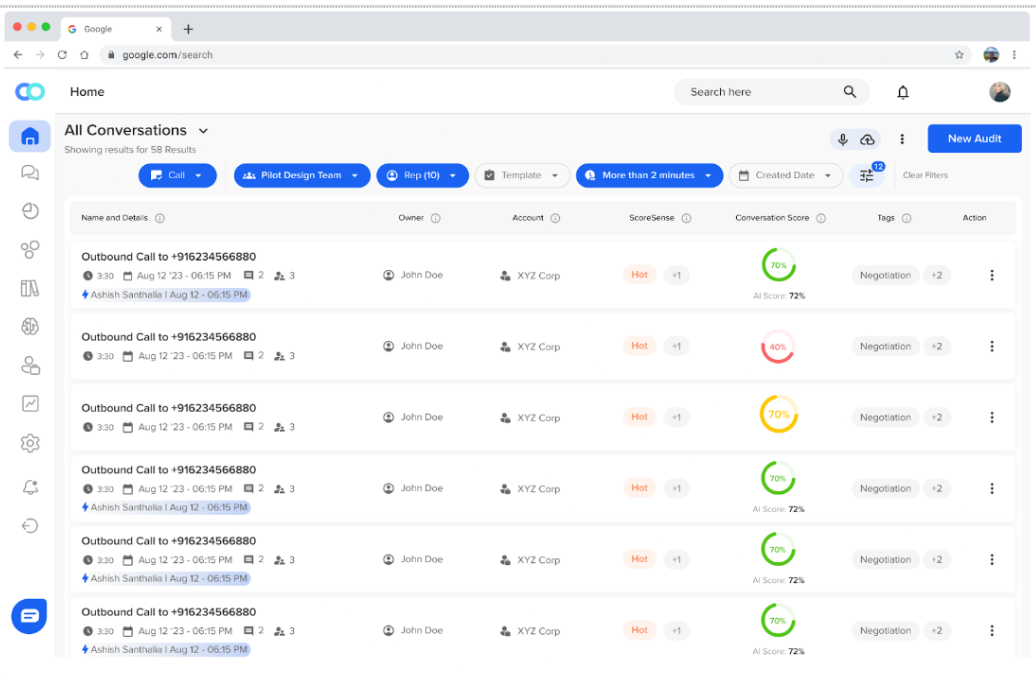

From real‑time agent support to post‑call insights and feedback loops, Convin addresses the full span of the insurance customer experience.

The stats verify it: up to 40% productivity boost, 30% reduction in claim management costs, and measurable retention gains via voice of customer insights.

1. Real‑time agent assist boosts claim satisfaction insurance

Convin’s “Real‑Time Agent Assist” monitors live customer calls, analyses tone and context, and delivers prompts to agents in real time.

Features include sentiment alerts, compliance checks, battle cards and live captions. When agents are supported in the moment, claim satisfaction insurance improves and the insurance customer experience strengthens.

2. Voice of Customer And Conversation Intelligence Turn Post Claim Feedback Into Action

Post‑call and post‑claim feedback tools from Convin capture multi‑channel sentiment, parse emerging trends, and spotlight service gaps.

For example, Convin’s Conversation Intelligence scaled call audit coverage from 1.5% to 30%, enabling meaningful insights into agent performance and policyholder satisfaction.

By converting voice data into operational change, insurers can continuously improve the claims journey experience and broader insurance customer experience. Feedback isn’t just collected, it’s utilised, closing loops and reinforcing trust.

Conversational intelligence for better customer experience

3. Claims Automation Insurance Through Conversation Intelligence And AI‑driven Workflows

Beyond agent support and feedback, Convin’s platform automates workflows: routing queries, validating documentation, initiating approvals and triggering alerts.

In internal cases, insurers saw up to 40% faster cycle times and 30% lower claim management costs. This means claimants wait less, receive clear updates and trust builds. Conclusion: With Convin’s claims automation insurance tools, the insurance customer experience becomes faster, leaner and more predictable.

What’s clear is this: blending empathy with automation isn’t just a strategy, it’s the future. And it’s reshaping how insurance earns trust.

Streamline claims with Convin, see it in action today.

Empathy + Automation = Stronger Insurance Customer Experience

Empathy isn’t a soft skill in insurance, it’s a strategic differentiator. And when paired with intelligent automation, it becomes the foundation for a truly resilient insurance customer experience.

From the emotional impact of claims to the operational gaps that frustrate policyholders, every interaction shapes trust and loyalty.

Simplifying the claims journey, capturing post claim feedback, and ensuring consistent communication are no longer optional, they're expected. Leaders who integrate empathy with claims automation insurance not only improve satisfaction but set new CX standards for the industry.

Convin brings this vision to life, combining real-time agent assist, voice of customer tools, and claims automation insurance features to streamline workflows and strengthen engagement.

Explore Convin’s AI‑powered claims automation, book your demo today.

FAQ

1. How would you improve the claims process?

Streamlining the claims journey experience starts with eliminating manual delays. Use claims automation insurance to handle documentation, trigger updates, and reduce cycle time. Enhance communication through real-time agent assist, ensuring clarity and empathy at every touchpoint. Platforms like Convin enable faster resolution and better oversight through automation and conversation intelligence.

2. How do you enhance or improve customer experience?

Improving the insurance customer experience involves three actions: responding quickly, communicating clearly, and personalizing support. Real-time coaching and post claim feedback analysis help identify gaps. Convin's voice of customer tools surface customer pain points, while automation ensures consistent claim satisfaction insurance across every interaction.

3. How to improve customer service in insurance companies?

Insurance companies can improve customer service by enabling agents with real-time insights, automating repetitive tasks, and capturing post claim feedback to act on it. Claims automation insurance platforms like Convin empower agents to deliver timely, empathetic service while reducing operational load.

4. What are the top 3 strengths in customer service?

- Empathy in high-stakes interactions like claims

- Speed and transparency through claims automation insurance

- Data-backed improvement using voice of customer tools like Convin

These strengths directly impact the insurance customer experience and drive policyholder loyalty.

.avif)

.avif)

.avif)