Every second in the insurance contact centre counts. With the average abandonment rate in some call centres tipping as high as 12–20%, as reported by LiveAgent in 2025, a remarkable share of potential policyholder interactions walk out the door.

Meanwhile, the global artificial‑intelligence‑in‑call‑centre market is set to exceed $10 billion by 2032, signalling that tech‑led transformation is no longer optional.

Inside this blog you’ll find how the modern insurance call centre is under pressure, why AI is the game‑changer, and how the right tools can re‑shape operations.

We’ll cover conversational AI, call‑center automation, voicebots, and how intelligent routing and real‑time agents support streamline workflows and improve accuracy.

You’ll discover how an AI‑powered suite can boost first‑call resolution, lower handling time, raise CSAT, and why now is the moment to act.

If you're steering an insurance call centre and seeking to move beyond legacy systems into smart service‑hub mode, you’ll want to read on.

Discover how Convin's AI redefines insurance call center strategy.

Why the Insurance Call Center Is Ripe for AI Innovation

The modern insurance call center is under intense pressure. Policyholders expect immediate answers, while agents juggle outdated systems and long workflows.

Studies note that over 60% of call‑centre customers abandon calls if held longer than 2 minutes. In insurance in particular, long wait times and manual tasks are cutting through customer satisfaction and retention alike.

1. Conversational AI for Insurance: The Demand For Intelligent Support

Customers calling into an insurance call center expect seamless interaction across channels. When agents lack real‑time context or face siloed data, the result is repeated questions, longer handling times and frustrated callers.

One report finds 53% of customers get irritated at repeating information across agents. Conversational AI for insurance addresses this by delivering intelligent, multi‑channel support, voice, chat, callback, with unified context.

That means smarter answers faster, and fewer hand‑offs.

2. Call Center Automation Solving Long Wait Times And Repetitive Manual Work

Manual tasks still dominate many insurance call centers: updating CRM records, checking policy history, routing calls, compliance checks.

One source cites average handle time (AHT) across industries at just over 6 minutes, with longer wait times a major complaint. In the insurance context, automation can cut down these delays.

According to Convin, their intelligent automation platform helps insurers reduce claim processing time by up to 70% and improve CSAT by 28%.

In conclusion, the insurance call center burdened by long queues and outdated tasks is primed for transformation. Intelligent automation and conversational AI aren’t just nice to have, they are strategic imperatives.

With the challenges clear, let’s explore how AI streamlines the workflows and improves accuracy within the insurance call center.

Upgrade to AI with Convin and solve wait-time and workflow issues.

How AI Transforms the Insurance Call Center Operations

AI is no longer experimental in service operations, it’s becoming foundational. For the insurance call center, AI means intelligent call routing, real‑time guidance for agents, and voicebots handling routine support, all working together to boost accuracy and speed.

1. AI Insurance Call Center: Streamlining Workflows And Decision‑Making

In an insurance call center, calls come in with varying complexity: claims, renewals, billing queries, regulatory checks.

Traditional routing often mismatches callers and agents, which leads to transfers and increased handling time. AI-enabled routing uses caller data, history and intent to send the call directly to the right agent or bot.

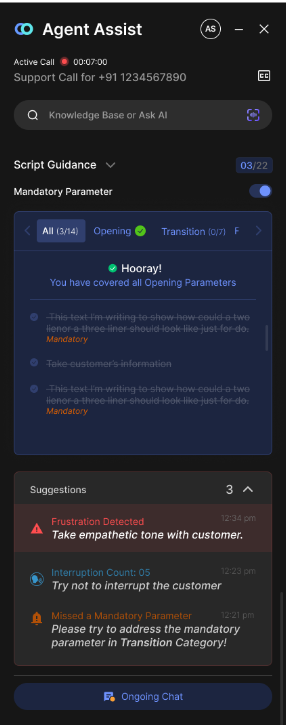

Meanwhile, real‑time agent assist tools, like Convin’s solution, monitor live conversations, transcribe them and provide contextual prompts instantly. (source)

Agents no longer have to dig through multiple systems mid‑call; relevant info appears proactively. This reduces idle time, lowers error rates and frees agents to focus on value‑add rather than administrative tasks.

In conclusion, AI transforms workflow and decision‑making within the insurance call center by eliminating bottlenecks, guiding agents at the point of interaction and enabling smarter routing of calls.

2. Voicebot Insurance Support: Reducing Human Error And Boosting Accuracy

Voicebots and chatbots powered by conversational AI for insurance are becoming core to handling high‑volume, low‑complexity tasks.

According to Convin, voicebots can resolve over 80% of routine policyholder queries instantly, easing the load on human agents.

With voicebot insurance support, tasks like policy renewal inquiries, premium payment updates or coverage FAQs are automated, reducing wait times, minimizing human error and increasing consistency.

These bots integrate with the same knowledge base that agents use, ensuring a unified response standard.

In conclusion, voicebot insurance support is not replacing agents, it’s complementing them, tackling the straightforward calls so human agents can focus on complex issues, and accuracy improves across the board.

Streamline live support with Convin’s AI-powered agent assist tools.

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

Core Benefits of AI in an Insurance Call Center

Once AI is embedded in the insurance call center, the benefits ripple across cost, service, and growth.

The key gains: personalized experiences, faster resolutions, reduced cost per contact, better compliance and stronger retention.

1. Conversational AI for Insurance: Personalization At Scale

Policyholders want more than functional service, they expect tailored interaction. Conversational AI for insurance delivers personalization by leveraging policy data, interaction history and customer context in real‑time.

Convin highlights that conversational AI in insurance is already embedded across servicing, claims and retention workflows, enabling insurers to scale service without simply adding headcount.

This personalization enhances loyalty. The more relevant the interaction, the higher the likelihood of cross‑sell/upsell and renewal.

In conclusion, embracing conversational AI for insurance means delivering individualized service at scale, not just blanket responses.

2. Call Center Automation Insurance: Faster Resolutions, Lower Costs

Automation within the insurance call center, covering workflows, post‑call analytics, compliance checks and voicebot tasks, directly impacts handle times and cost per contact.

Convin’s intelligent automation helps reduce claim‑processing time by up to 70% and lifts CSAT by 28%.

These gains come from funneling routine tasks into bots/automation and reserving human agents for high‑value calls.

In conclusion, call center automation insurance isn’t just streamlining tasks, it’s driving metrics that matter: quicker resolution, less cost, better customer outcome.

Drive loyalty and cut costs with Convin’s automation solutions.

Convin’s AI‑Powered Suite for Insurance Call Centers

Here we shift focus to how Convin’s suite turns theory into action within the insurance call center. From real‑time assist to voice of customer analytics, each component ties back to the primary keyword: insurance call center.

1. AI Insurance Call Center Tools That Deliver Instant ROI

Convin’s real‑time agent assist tool empowers agents during live conversations in the insurance call center. Features include live speech‑to‑text, recommended next actions, compliance prompt, and integration with knowledge base.

One launch announcement noted that Agent Assist could boost contact centre performance and drive “21% higher sales”.

In conclusion, in an insurance call center setting, Convin's tools provide measurable ROI, meaning fewer manual tasks, better outcomes, and strengthened competitiveness.

2. Voicebot Insurance Support, Real‑Time Coaching, And VOC Insights

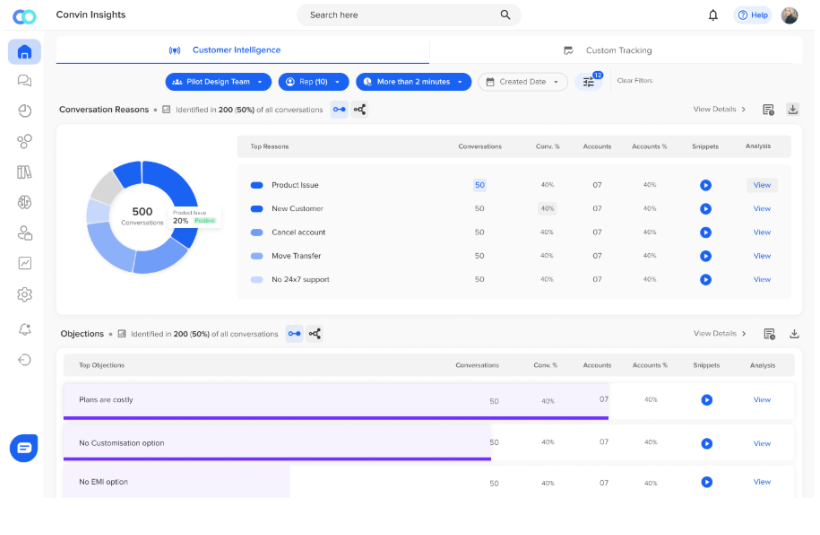

Beyond agent assist, Convin’s platform encompasses conversational AI for insurance (voicebots), contact‑center conversation intelligence and voice‑of‑customer (VOC) software.

Through conversational AI for insurance, insurance call centers can automate policyholder interactions and feedback loops. Convin’s conversation intelligence captures every call, analyzes sentiment and flags compliance risks.

These insights enable call center leaders to coach agents proactively and refine processes. Voicebot insurance support handles high‑volume service tasks, freeing agents for complex issues. Together, these elements form a smart service hub for the insurance call center.

In conclusion, integrating voicebot insurance support, real‑time coaching and VOC insights ensures that the insurance call center is not just responsive, but anticipatory and strategic.

Explore Convin’s suite now, transform your insurance call center with AI.

The Future of the Insurance Call Center Is AI‑Driven

The insurance call center is undergoing a permanent shift, from reactive support desks to proactive, AI-driven service hubs.

As policyholder expectations rise and operational costs tighten, traditional call center models are no longer sustainable. AI delivers the transformation insurers need, streamlining workflows, reducing human error, and driving measurable improvements in resolution time, customer satisfaction, and agent performance.

Convin’s AI-powered suite brings this vision to life. From real-time agent assist to voicebot insurance support and voice of customer analytics, it empowers insurance teams to deliver faster, smarter, and more consistent service across every interaction.

For insurers ready to move beyond outdated scripts and inefficiencies, intelligent automation is no longer optional, it’s a strategic edge.

Explore Convin’s suite now, transform your insurance call center with AI.

FAQ

1. How is AI transforming call centers?

AI is streamlining call center operations by automating routine tasks, improving call routing, and providing real-time agent support. This leads to faster resolutions, higher accuracy, and improved customer satisfaction. Platforms like Convin use AI to monitor conversations live and guide agents with intelligent prompts, enhancing productivity without increasing headcount.

2. How is AI transforming the insurance industry?

AI is reshaping the insurance industry through automated claims processing, fraud detection, underwriting assistance, and customer support. In insurance call centers, AI improves speed, accuracy, and compliance by handling policyholder queries through voicebots and assisting agents in real time, as seen in Convin’s AI-powered solutions.

3. How is AI transforming customer service?

AI enhances customer service by enabling 24/7 support through chatbots and voicebots, personalizing responses using customer data, and reducing wait times. With tools like Convin’s conversational intelligence and agent assist, companies deliver faster, context-aware service that improves customer experience and retention.

4. How is AI used in the BPO industry?

In the BPO industry, AI automates repetitive processes, analyzes call quality, and supports multilingual, omnichannel customer engagement. It enables scalability and consistency across support functions. Convin’s AI capabilities help BPOs streamline workflows, ensure compliance, and deliver high-quality service without manual overhead.

.avif)