Insurance customer operations are under constant pressure. Call volumes continue to rise, claims resolution takes longer, and service quality becomes inconsistent as teams struggle to scale. When operations fail to respond quickly or accurately, customer trust erodes across sales, claims, and renewals.

Generative AI in insurance helps teams absorb this pressure by supporting decision-making and conversation handling across customer operations. Instead of replacing human judgment, it assists agents by generating responses, summaries, and insights from large volumes of interaction data. This allows insurance contact centers to reduce manual effort, improve consistency, and maintain control as complexity increases.

As insurers adopt generative AI in insurance, the focus shifts from automation alone to operational readiness. Teams look for ways to improve efficiency, visibility, and reliability across customer interactions without introducing risk or disrupting existing workflows.

Explore Generative AI Solutions for Insurance Today

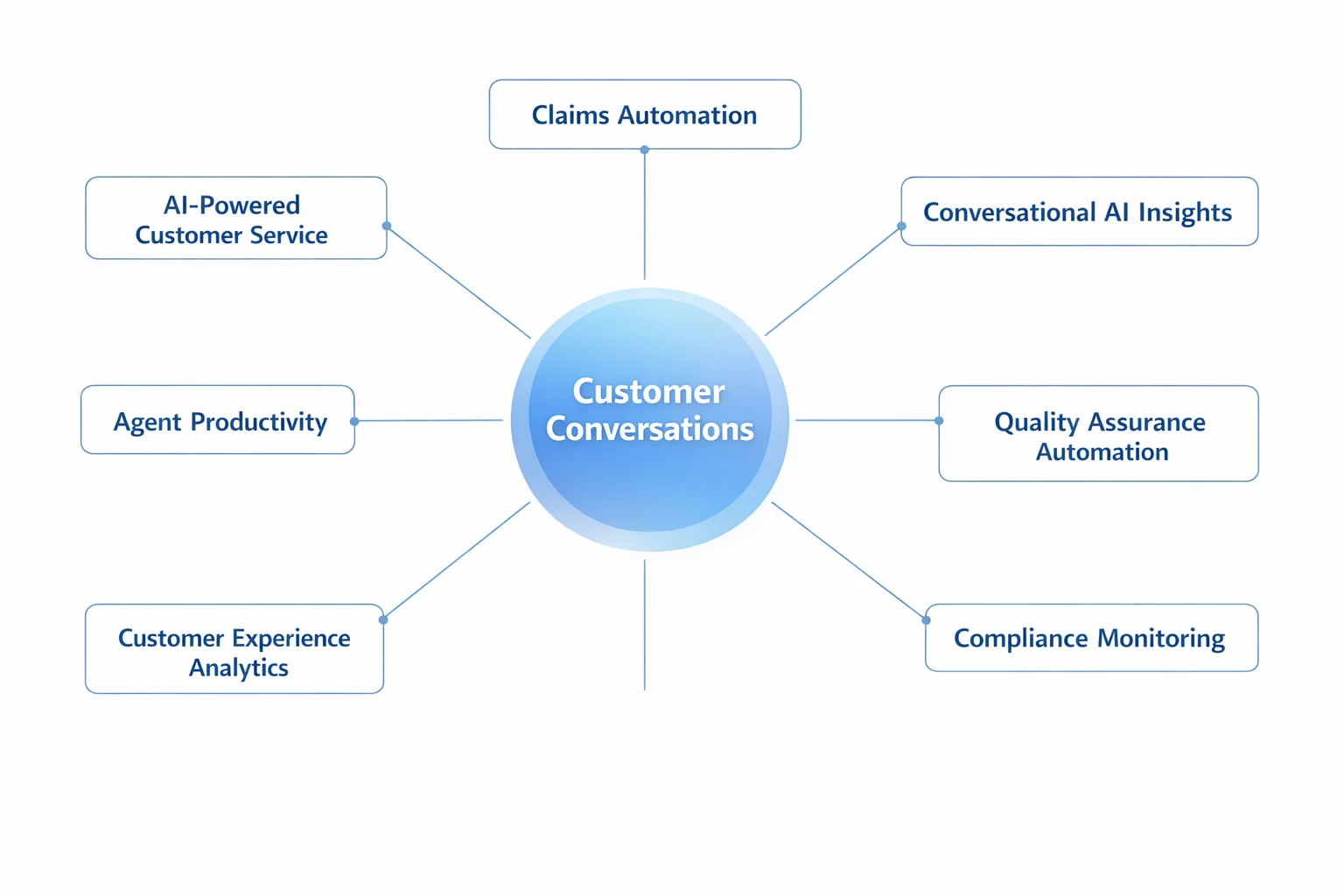

How Is Generative AI in Insurance Used?

Generative AI in insurance supports daily customer interactions across insurance contact centers. It helps agents work faster without removing human judgment. Insurance contact centers apply generative AI in insurance across voice and digital conversations. The focus stays on speed, accuracy, and consistency.

Generative AI in insurance is commonly used to:

- Assist agents during live customer interactions

- Reduce manual documentation work

- Improve response quality across touchpoints

See How Convin Enhances Insurance Contact Centers

Use Case 1: AI-Powered Customer Service

AI-powered customer service helps insurers manage high interaction volumes. Generative AI in insurance assists agents during live conversations, instead of searching multiple systems, agents get suggested responses. These responses are based on conversation context and past interactions.

Insurance contact centers use AI-powered customer service to:

- Handle repetitive customer questions faster

- Maintain consistent responses across agents

- Reduce customer wait times

Generative AI in insurance improves agent productivity without removing control. Agents stay in charge of final responses. Convin supports AI-powered customer service through conversation intelligence. It identifies response gaps and coaching opportunities.

Track customer experience analytics at scale

This blog is just the start.

Unlock the power of Convin’s AI with a live demo.

Use Case 2: Claims Automation Support

Claims automation remains a major bottleneck in insurance operations. High claim volumes overwhelm insurance contact centers. Agents handle multiple claim conversations every day. They often switch between systems to capture details. Generative AI in insurance simplifies claim-related conversations. It supports agents during live and post-call workflows.

Agents usually spend minutes summarizing claim details manually. This slows resolution and increases error risk. Generative AI in insurance automates conversation summaries. It captures claim intent, next steps, and missing information.

Insurance contact centers use claims automation support to:

- Reduce manual documentation effort across claim interactions

- Speed up claim handoffs between teams and departments

- Improve visibility into claim progress and status

Claims automation improves agent productivity and consistency. Agents focus more on customers and less on paperwork. Accurate summaries reduce rework caused by missing details. Claims move forward without repeated follow-ups. Generative AI in insurance also helps standardize claim information. This improves downstream processing and reporting.

Improve claims automation oversight

Use Case 3: Conversational AI Insights

Conversational AI insights help insurance teams understand real customer conversations. They show what customers actually say, not what teams assume. Insurance contact centers handle thousands of conversations daily. Hidden patterns often go unnoticed without analysis.

Generative AI in insurance depends on clean conversation data. Without context, automation delivers weak outcomes. Insurance contact centers use conversational AI insights to identify intent. They also uncover sentiment and repeated friction points.

These insights help customer operations teams:

- Improve agent training programs using real conversation examples

- Fix recurring customer issues that slow resolution

- Strengthen customer experience analytics beyond surveys

Conversational AI insights bring structure to unstructured data. They turn conversations into actionable signals. Generative AI in insurance becomes more effective with better insights. Every downstream use case benefits from stronger context.

Better insights improve response quality and decision-making. They reduce guesswork across insurance contact centers. Convin delivers conversational AI insights across all customer interactions. This helps leaders make informed operational decisions.

Discover coaching needs with conversational AI insights

Use Case 4: Agent Productivity Improvement

Agent productivity is critical for scaling customer operations. Insurance contact centers depend on efficient agents to meet demand. Agents juggle customer conversations, systems, and follow-ups. This creates fatigue and slows performance.

Generative AI in insurance reduces repetitive and manual work. It supports agents throughout the interaction lifecycle. After-call work often consumes valuable agent time. Generative AI in insurance automates summaries and action items.

Insurance contact centers improve agent productivity by:

- Reducing documentation time after every interaction

- Speeding up case closures with clearer next steps

- Supporting faster agent ramp-up through guided insights

Higher agent productivity improves service consistency. Customers receive quicker and clearer responses. Agent productivity improvements reduce burnout. They also lower attrition risk across teams. Generative AI in insurance helps managers identify effort-heavy tasks. This enables better workforce planning.

Improve agent productivity using analytics

Use Case 5: Customer Experience Analytics

Customer experience analytics measure how customers actually feel. They go beyond surface-level metrics. Insurance contact centers interact with customers at critical moments. Emotions run high during claims and service issues.

Generative AI in insurance uses conversation signals to improve accuracy. Tone, pauses, and phrasing reveal real sentiment. Traditional surveys miss most customer feedback.

Only a small fraction of customers respond. Conversation data fills this gap. It captures feedback from every interaction.

Insurance contact centers use customer experience analytics to:

- Identify service breakdowns early across channels

- Track sentiment trends over time

- Improve consistency across teams and locations

Customer experience analytics help leaders move from reaction to prevention. Issues are addressed before escalation. Generative AI in insurance relies on these insights for better outcomes. Context improves every automated response.

Customer experience analytics guide smarter operational decisions. They support training, staffing, and process improvement. Convin strengthens customer experience analytics using real conversations. This provides continuous, unbiased visibility across customer operations.

Align teams using customer experience analytics

Use Case 6: Quality Assurance Automation

Quality assurance automation replaces manual sampling methods. It helps insurance teams scale quality checks. Manual audits review only a small percentage of customer calls.

Most interactions go unreviewed.

Generative AI in insurance enables broader quality coverage. Automation ensures no conversation is ignored. Insurance contact centers rely on quality assurance automation to improve consistency. It brings structure to quality evaluations. Automation scales quality checks across operations. It reduces dependency on large QA teams.

Insurance contact centers use quality assurance automation to:

- Audit every customer interaction across channels

- Reduce QA effort and review time

- Ensure consistent service standards for all agents

Quality assurance automation improves fairness and accuracy. Every agent is measured using the same criteria. Generative AI in insurance supports consistent evaluations at scale. Bias from manual reviews is reduced. Quality data improves coaching and training. Teams know exactly where to improve.

Improve quality assurance automation without manual reviews

Use Case 7: Compliance Monitoring

Compliance monitoring is essential in insurance operations. Every customer interaction carries regulatory risk. Insurance contact centers handle sensitive personal information. Even small errors can lead to serious penalties.

Generative AI in insurance must operate within regulations. Automation without controls increases exposure. Manual compliance checks are slow and reactive. Issues surface only after customer escalation or audits. Automation improves coverage and response time. Risks are identified while conversations happen.

Insurance contact centers use compliance monitoring to:

- Detect risky conversations early across channels

- Reduce regulatory exposure before violations escalate

- Support faster and smoother audits

Compliance monitoring protects both customers and insurers. It ensures conversations follow approved guidelines. Generative AI in insurance needs strong guardrails. Human oversight remains critical.

Monitor compliance without slowing agents

The Operational Takeaway

Generative AI in insurance is reshaping customer operations across the industry. Its real impact depends on readiness, data quality, and clear operational goals. Hype fades quickly when teams lack visibility and governance.

Insurance leaders must focus on building strong foundations first. Conversation data, quality controls, and compliance guardrails matter most. This is what enables generative AI in insurance to deliver lasting value. Convin helps insurance contact centers strengthen agent productivity, compliance monitoring, and customer experience analytics. It gives leaders the visibility needed to adopt generative AI in insurance responsibly and confidently.

Get started with Convin’s solution today.

FAQs

1. What is generative AI in insurance?

Generative AI in insurance refers to AI systems that create responses, insights, and summaries from data. It helps insurers improve customer operations without replacing agents.

2. How is generative AI in insurance used in customer operations?

Generative AI in insurance supports agents during customer interactions. It assists with responses, summaries, and workflow guidance.

3. Does generative AI in insurance replace insurance agents?

No. Generative AI in insurance assists agents rather than replacing them. Human judgment remains essential in insurance operations.

4. What are the biggest benefits of generative AI in insurance?

The biggest benefits include better agent productivity, faster resolutions, and improved consistency. It also strengthens compliance and quality monitoring.

5. How should insurance leaders prepare for generative AI in insurance?

Insurance leaders should focus on clean conversation data and governance. Strong analytics and oversight enable responsible adoption.

.webp)

.avif)